Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Joining Air Canada’s Aeroplan loyalty program is free and there are a handful of ways to earn points, but the easiest way is to sign up for one of the best Aeroplan credit cards.

With one of these travel cards, every purchase earns Aeroplan points, worth 2.23 cents per point on average, according to NerdWallet analysis. Plus, these cards will reward your loyalty with special perks and benefits that will make your next trip even more enjoyable.

- The best co-branded Aeroplan credit cards

- The best credit cards to earn Aeroplan points

- Why you should trust us

- Summary of our selections

- How Aeroplan credit cards work in Canada

Best co-branded Aeroplan cards

Great for low income requirements

TD® Aeroplan® Visa* Platinum Card

-

Annual Fee$89Conditions Apply. Must apply by May 28, 2023.Waived first year

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances.

-

Rewards Rate0.67x-1x PointsEarn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

-

Intro OfferUp to 20,000 PointsEarn up to 20,000 Aeroplan points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†. Conditions Apply. Must apply by May 28, 2023.

The TD® Aeroplan® Visa Platinum* Credit Card may be too short on bells and whistles for some credit card veterans, but those seeking a straightforward, affordable introduction to the Aeroplan universe should find what they’re looking for.

Pros

- A low annual fee, which can be refunded in the first year if you make a purchase in the first three months.

- The mobile device insurance included should bring peace of mind to some users.

Cons

- There are few ways to earn double points, even during the introductory period.

- Intro offer: Earn up to 20,000 Aeroplan points† plus, first year no Annual Fee†. Conditions Apply. Must apply by May 28, 2023.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by May 29, 2023.

- Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Platinum* Cardholder.

- Flight/Trip Delay Insurance†: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Emergency Travel Assistance Services†: Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- To be eligible, you must be a Canadian resident and be of the age of majority in your province/territory of residence.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Great for no annual fee in the first year

TD® Aeroplan® Visa Infinite* Card

-

Annual Fee$139Apply online by May 28, 2023. Terms and conditions apply.Waived first year

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1x-1.5x PointsEarn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

-

Intro OfferUp to 55,000 PointsEarn up to 55,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 30,000 Aeroplan points when you spend $5,000 within 180 days of Account opening†. Plus, earn an anniversary bonus of 15,000 Aeroplan points when you spend $7,500 within 12 months of Account opening†. Must apply by May 28, 2023.

The TD Bank Aeroplan Visa Infinite Card provides access to exclusive food, golf and drink experiences, making it an excellent choice for shoppers with a taste for the finer things. The $7,500 spending target in the first year should put the introductory point offers within reach for many cardholders.

Pros

- A low annual fee and unique perks, including 10% off car rentals at Avis and Budget.

- Earn points twice when you provide your Aeroplan number.

Cons

- Opportunities for earning more than 1.5x the points are rather limited.

- Some perks, like a once-every-four-years NEXUS rebate, might not blow your hair back.

- Intro offer details: Earn up to 55,000 Aeroplan points†. Plus, first year no Annual Fee†. Conditions Apply. Must apply by May 28, 2023.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by May 29, 2023.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.

- Complimentary Visa Infinite Concierge†: On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $1,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, a $60,000 annual personal income or $100,000 household annual income is required. You must also be a Canadian resident and be the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Best TD Aeroplan card + great for Priority Airport Services

TD® Aeroplan® Visa* Infinite Privilege* Card

-

Annual Fee$599

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1.25x-2x PointsEarn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®). Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases. Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

-

Intro OfferUp to 115,000 PointsEarn up to 115,000 Aeroplan points: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 60,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†. Plus, earn an anniversary bonus of 35,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†. Must apply by May 28, 2023.

The TD® Aeroplan® Visa* Infinite Privilege* Card comes with strong travel insurance and perks, plus healthy earn rates on everyday purchases.

Pros

- Complimentary Visa Airport Companion membership with six airport lounge visits included each year.

- Tons of airport perks, including priority check-ins, boarding, baggage handling, airport upgrades, and airport standby.

Cons

- Substantial annual fee.

- Intro offer: Earn up to 115,000 Aeroplan points†. Conditions Apply. Must apply online by May 28, 2023.

- Earn a welcome bonus of 20,000 Aeroplan points when you make. your first purchase with your new card†.

- Earn an additional 60,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn an anniversary bonus of 35,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Global Airport Lounge Access†: Receive a complimentary membership to the Visa Airport Companion† Program hosted by Dragonpass International Ltd. and take advantage of six lounge visits included for each Cardholder per membership year at over 1,200 airport lounges worldwide. Enroll through the Visa Airport Companion App or through visaairportcompanion.ca

- Complimentary Visa Infinite Concierge† : On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties. Enjoy an additional 8th benefit at over 200 properties, exclusively for Visa Infinite Privilege cardholders.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $2,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Flight/Trip Delay Insurance†: Up to $1,000 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: For delayed baggage over 4 hours, up to $1,000 of coverage per insured person for the purchase of essentials, such as clothing and toiletries. For lost baggage, up to $2,500 of coverage per insured person.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Save time at the border with NEXUS: Enroll for a NEXUS and once every 48 months get an application fee rebate (up to $100 CAD)†. Additional Cardholders can also take advantage of this NEXUS rebate.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Best Aeroplan business credit card from TD Bank

TD® Aeroplan® Visa* Business Card

-

Annual Fee$149Waived first year

-

Interest Rates14.99% / 22.99%14.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1x-2x Points2x on Air Canada purchases, including Air Canada Vacations. 1.5x on travel, dining and select business categories, such as shipping, internet, cable and phone services. 1x on everything else.

-

Intro OfferUp to 60,000 PointsEarn 10,000 points once you make your first purchase. Earn 20,000 points by spending $5,000 in the first three months. Earn 30,000 points (2,500 per month) by spending $5,000 each month during the first year. Plus, get an annual fee rebate for the first year for the primary cardholder and 2 additional cardholders. Offer expires May 28, 2023.

The TD Aeroplan Visa Business Card impresses with its obtainable welcome bonus, low interest rate and increased earn rate on essential business purchases.

Pros

- A 14.99% interest rate on purchases is unusual for a card packing this many benefits, including a healthy earn rate on business purchases like shipping and internet.

- Wide range of insurance provided.

- Travel perks include statement Credits For NEXUS Holders, free checked bags and Maple Leaf Lounge guest pass.

Cons

- Most travel perks require cardholders to hit spending thresholds before they can be claimed.

- Smaller businesses may not spend enough to score the full welcome bonus.

- Intro offer: Earn 10,000 points once you make your first purchase. Then, earn 20,000 points by spending $5,000 in the first three months, and earn 30,000 points (2,500 per month) by spending $5,000 each month during the first year. Plus, get an annual fee rebate for the first year for the primary cardholder and 2 additional cardholders. Offer expires May 28, 2023.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

Best overall Aeroplan card

American Express® Aeroplan® Reserve Card

-

Annual Fee$599

-

Interest Rates20.99% / 21.99%20.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1.25x-3x Points3x on eligible purchases made directly with Air Canada and Air Canada Vacations, 2x on eligible Dining and Food Delivery purchases in Canada, and 1.25x on everything else.

-

Intro OfferUp to 85,000 PointsNew American Express® Aeroplan®* Reserve Cardmembers can earn up to 85,000 Aeroplan points: Earn 55,000 Aeroplan points after spending $6,000 in net purchases on your Card within the first 6 months of Cardmembership. Plus, you can also earn 5,000 Aeroplan points for each monthly billing period in which you spend $1,000 in purchases on your Card for the first 6 months of Cardmembership. That could add up to 30,000 Aeroplan points.

Comprehensive travel insurance, Air Canada benefits, impressive earn rates and unlimited rewards make the American Express Aeroplan Reserve Card a strong choice for frequent travellers.

Pros

- Strong earn rates with unlimited rewards.

- Air Canada airport benefits, like Maple Leaf Lounge access, a free checked bag, Priority Airport Check-In, Priority Boarding for you and up to eight travel companions.

Cons

- A high $599 annual fee.

- The highest earn rate only applies to Air Canada travel purchases, so this card might not be a good fit if you prefer another airline.

- New American Express® Aeroplan®* Reserve Cardmembers can earn up to 85,000 Aeroplan points:

- Earn 55,000 Aeroplan points after spending $6,000 in net purchases on your Card within the first 6 months of Cardmembership.

- Plus, you can also earn 5,000 Aeroplan points for each monthly billing period in which you spend $1,000 in purchases on your Card for the first 6 months of Cardmembership. That could add up to 30,000 Aeroplan points.

- New Cardmembers: Earn up to $2,700 in value within your first year. Spend applies to bonus point offers valued at up to $1,700.

- New Cardmembers: Receive up to $100 CAD in statement credits every four years when a NEXUS application or renewal fee is charged to your American Express Aeroplan Reserve Card.

- Standard Earn Rate: Earn 3X the points on eligible purchases made directly with Air Canada®* and Air Canada Vacations®*.

- Standard Earn Rate: Earn 2X the points on eligible Dining and Food Delivery purchases in Canada.

- Earn 2X the points on eligible purchases with Rocky Mountaineer®**. Plus, you could receive a Complimentary Hotel Room Category Upgrade, on the first and last night, and a Complimentary Upgrade from SilverLeaf to GoldLeaf class of service when you book directly with Rocky Mountaineer using your Aeroplan Reserve Card.

- Standard Earn Rate: Earn 1.25X the points on everything else.

- Get through the airport quicker with Air Canada Priority Check-In, Air Canada Priority Boarding and Air Canada Priority Baggage Handling.

- Receive one Annual Worldwide Companion Pass when you spend $25,000 in net purchases prior to your Card anniversary date; your Pass entitles you to buy an accompanying Air Canada economy class ticket for a companion at a fixed base fare from $99 to a maximum of $599 CAD (plus taxes, fees, charges, and surcharges).

- Enjoy access to select Air Canada Maple Leaf Lounges™* and Air Canada Café™ in North America for you and a guest, with a same day ticket on a departing Air Canada or Star Alliance flight.

- Enjoy your eligible first checked bag free for up to 9 people travelling on the same reservation on Air Canada flights.

- Roll over any unallocated Aeroplan Elite™* Status Qualifying Miles and unused eUpgrade Credits to the following year to enjoy during your travels.

- American Express® Experiences opens doors for you to access a number of special events, including special dining experiences, VIP parties, advance film screenings and more.

- Get more from your travel experience at Toronto Pearson International Airport with:

- Access to Pearson Priority Security Lane.

- Complimentary valet service at the Express Park and Daily Park.

- 15% discount on parking rates at the Express Park and Daily Park.

- 15% discount on Car Care Services.

- Get access to more than 1,200 Priority Pass™ airport lounges and enjoy an oasis of comfort before your flight, regardless of your airline or cabin class.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best charge card to earn Aeroplan points

American Express® Aeroplan®* Card

-

Annual Fee$120

-

Interest RatesCharge Card0% if you pay your balance in full every month, 30% annual interest rate on the remaining amount if you don’t.

-

Rewards Rate1x-2x Points2x on eligible purchases made directly with Air Canada and Air Canada Vacations, 1.5x on eligible Dining and Food Delivery purchases in Canada, and 1x on everything else.

-

Intro OfferUp to 50,000 PointsNew American Express® Aeroplan®* Cardmembers can earn up to 50,000 Aeroplan points: Earn 35,000 Aeroplan points after spending $3,000 in net purchases on your Card within the first 6 months of Cardmembership. Plus, earn 2,500 Aeroplan points for each monthly billing period in which you spend $500 in purchases on your Card for the first 6 months of Cardmembership. That could add up to 15,000 Aeroplan points.

The American Express Aeroplan Card can help you rack up points at an impressive clip, especially if you make regular use of food delivery apps. No pre-set spending limit means freedom and flexibility — just remember to pay down that balance every month.

Pros

- Relatively low annual fee.

- Plenty of opportunities to score double points.

Cons

- As a charge card, unpaid balances are subject to a 30% annual interest rate.

- Perks may not be enough to scratch the “premium” itch for those used to other luxury cards.

- New American Express® Aeroplan®* Cardmembers can earn up to 50,000 Aeroplan points:

- Earn 35,000 Aeroplan points after spending $3,000 in net purchases on your Card within the first 6 months of Cardmembership.

- Plus, earn 2,500 Aeroplan points for each monthly billing period in which you spend $500 in purchases on your Card for the first 6 months of Cardmembership. That could add up to 15,000 Aeroplan points.

- New Cardmembers: Earn up to $1,100 in value within your first year. Spend applies to bonus point offers valued at up to $1,000.

- Standard Earn Rate: Earn 2X the points on eligible purchases made directly with Air Canada®* and Air Canada vacations®*.

- Standard Earn Rate: Earn 1.5X the points on eligible Dining and Food Delivery purchases in Canada.

- Standard Earn Rate: Earn 1X the points on everything else.

- Enjoy your first checked bag free (up to 23kg/50lb) for up to 9 people travelling on the same reservation on Air Canada®* flights.

- Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $10,000 in eligible net purchases charged to your Card.

- As an American Express Aeroplan Cardmember, you can often book flight rewards for even fewer points with preferred pricing.

- American Express® Experiences: From music and movies, to specially curated dining and online shopping opportunities, stay connected with all that we have to offer from the comfort of your own home.

- Enjoy an array of travel related insurance benefits such as Lost or Stolen Baggage Insurance and up to $500,000 in Travel Accident Insurance.

- 24/7 Customer Service and Emergency Card Replacement.

- As part of our commitment to sustainability, the American Express® Aeroplan®* Card has been made with 70% reclaimed plastic.

- No pre-set spending limit on purchases gives you flexibility. Using a charge card is a great way to manage your finances as the balance must be paid in full each month.*

- *American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best Aeroplan business credit card for rewards on travel purchases

American Express® Aeroplan®* Business Reserve Card

-

Annual Fee$599

-

Interest Rates16.99% / 21.99%16.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1.25x-3x PointsEarn 3x points for every $1 spent on eligible purchases made directly with Air Canada and Air Canada Vacations®*. Earn 2x points for every $1 spent on eligible hotels and car rentals. Earn 1.25x points for every $1 spent on everything else.

-

Intro OfferUp to 85,000 PointsEarn up to 85,000 Welcome Bonus Aeroplan®* points: Earn 25,000 Aeroplan points after spending $3,000 in net purchases on your Card within the first three months of Cardmembership. Plus, earn 5,000 Aeroplan points for each monthly billing period in which you spend $2,000 in purchases on your Card for the first twelve months of Cardmembership. That could add up to 60,000 Aeroplan points.

The annual fee is no joke, but cardmembers have plenty of reasons to smile thanks to the American Express® Aeroplan®* Business Reserve Card’s strong earn rates, extensive travel benefits and overall convenience.

Pros

- Serious bonus point potential in the first six months.

- Relatively low interest rate.

- Strong earn rates on eligible Air Canada travel purchases, hotel bookings and car rentals, even after the 6-month even after the introductory period ends. Plus, premium travel perks and benefits, like airport lounge access and priority upgrades, to make sure your next trip goes smoothly.

Cons

- High annual fee.

- Earning the Annual Worldwide Companion Pass may not be possible for all businesses.

- The purchase interest rate rockets to 23.99% if you miss a payment.

- Earn up to 85,000 Welcome Bonus Aeroplan®* points:

- Earn 25,000 Aeroplan points after spending $3,000 in net purchases on your Card within the first three months of Cardmembership.

- Plus, earn 5,000 Aeroplan points for each monthly billing period in which you spend $2,000 in purchases on your Card for the first twelve months of Cardmembership. That could add up to 60,000 Aeroplan points.

- Earn up to $2,600 or more in value within your first year.

- Earn Aeroplan points that you can redeem in a variety of ways.

- Earn 3 points for every $1 spent on eligible purchases made directly with Air Canada and Air Canada Vacations®*.

- Earn 2 points for every $1 spent on eligible hotels and car rentals.

- Earn 1.25 points for every $1 spent on everything else.

- Make the most out of a full suite of business management tools that give you more control over your business – anytime and anywhere.

- Leverage your cash flow with the option of carrying a balance or paying in full each month.

- Control employee expenses plus track and accumulate points on your account with Supplementary Cards, so you have an opportunity to maximize the points you earn.

- Unlock business travel possibilities to make every work trip one to look forward to.

- Access more than 1,200 Priority Pass™ airport lounges around the globe. That means an oasis of comfort before your flight—regardless of your choice of airline or cabin class.

- Enjoy access to select Air Canada Maple Leaf Lounges™ for you and a guest, and Air Canada Café™; in North America, with a same day ticket on a departing Air Canada or Star Alliance®* flight.

- Enjoy Priority Check-In, Priority Boarding, and Priority Baggage Handling when you fly with Air Canada, together with up to eight companions.

- Receive one Annual Worldwide Companion Pass when you spend $25,000 in net purchases prior to your Card anniversary date; your Pass entitles you to buy an accompanying Air Canada economy class ticket for a companion at a fixed base fare from $99 to a maximum of $599 CAD (plus taxes, fees, charges, and surcharges).

- Stay focused on getting where you need to go. Receive up to $100 CAD in statement credits every four years when NEXUS application or renewal fees are charged to your Aeroplan Business Reserve Card.

- Pay with your American Express Aeroplan Business Reserve Card and present your Aeroplan Membership Card at over 170 Aeroplan partner brands and 120 online retailers via the Aeroplan eStore to earn points twice.

- If you’re departing from Toronto Pearson International Airport, enjoy the benefits of being an American Express Aeroplan Business Reserve Cardmember. Get more from your travel experience with access to Pearson Priority Security Lane, Complimentary Valet Service, 15% discount on parking rates, and 15% discount on Car Care Services.

- Roll over any unallocated Aeroplan Elite™ Status Qualifying Miles and unused eUpgrade Credits to the following year to enjoy during your travels.

- Enjoy priority access to the standby list and eUpgrades. Get prioritized on the standby waitlist for an Air Canada flight and higher priority when you request an eUpgrade.

- Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $5,000 in eligible net purchases charged to your Card.

- Book flight reward tickets for even fewer points with Air Canada. In addition to flights, you can also redeem for hotel stays, car rentals, vacation packages, merchandise and more.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best corporate Aeroplan credit card

American Express® Aeroplan®* Corporate Reserve Card

-

Annual Fee$699

-

Interest RatesN/A

-

Rewards Rate1x-1.5xEarn 1 Aeroplan point for every $1 in business purchases to redeem for flights, hotels, merchandise and more. Earn 1.5% cash back annually on eligible Air Canada purchases charged to your Card when your company is enrolled in Air Canada for Business.

-

Intro OfferN/A

The American Express®* Aeroplan® Corporate Reserve Card earns two types of rewards: Aeroplan points and cash back. It also comes with a host of premium travel perks, like priority check-in, priority boarding, priority baggage handling, airport lounge access and annual companion passes.

Pros

- Earn Aeroplan points and cash back on eligible Air Canada purchases.

- Luxurious travel perks.

- Comprehensive insurance coverage.

Cons

- Steep $699 annual fee.

- No way to earn more than 1 Aeroplan point per $1 spent through the card itself.

- Earn 1.5% cash back annually on eligible Air Canada purchases charged to your Card when your company is enrolled in Air Canada for Business.

- Earn 1 Aeroplan point for every $1 in business purchases to redeem for flights, hotels, merchandise and more.

- Enjoy an elevated travel experience with priority airport services, premium benefits, Maple Leaf Lounge™ access and more.

- Everyday corporate spend can add up to status qualifying miles – getting you to Aeroplan Elite™* Status faster.

- Get a companion Air Canada economy class ticket up to a maximum base fare of $599 CAD (excludes taxes, fees, charges and surcharges). Conditions apply.

- Enjoy Priority Check-In for you and with up to eight companions when you traveling on the same reservation for any trip originating on an Air Canada flight.

- Get your bags on the carousel first when you arrive at your destination with special Priority Baggage Handling priority bag tags ffor you and up to eight others travelling on the same reservation. This applies to travel originating on an Air Canada flight.

- Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $5,000 in eligible purchases charged to your Card.

Best no-fee Aeroplan card

CIBC Aeroplan® Visa Card

-

Annual Fee$0

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances (21.99% for Quebec residents).

-

Rewards Rate0.67x-1x Points1x per $1 spent on gas, groceries and Air Canada travel purchases, and 1x per $1.50 spent on all other purchases.

-

Intro Offer10,000 PointsEarn 10,000 Aeroplan points when you make your first purchase. New cardmembers only.

Most cards make you choose between low fees or valuable travel rewards, but the CIBC Aeroplan Visa offers both.

Pros

- An attractive intro offer that could be enough for a one-way economy class flight in North America.

- Your Aeroplan membership will help you earn points twice as fast at Aeroplan partners and retailers in the Aeroplan eStore when you pay with your Aeroplan credit card.

Cons

- To get the best value, you’ll have to be loyal to Air Canada and the Aeroplan rewards program.

- Earn rate on included categories is lower than some other no-fee cards.

- 1x Aeroplan points per dollar on gas, groceries and Air Canada travel purchases, up to $40,000 annual spend.

- 1x Aeroplan points per $1.50 spent on all other purchases, including gas, groceries and Air Canada travel purchases that exceed the $40,000 threshold.

- Earn points twice at over 150 Aeroplan partners and 170+ online retailers through the Aeroplan eStore.

- Aeroplan Points never expire and can be redeemed for a variety of travel, merchandise, gift card, and other rewards offered by Aeroplan’s participating partners and suppliers.

- $0 annual fee.

- Primary Aeroplan credit cardholders may get access to preferred pricing, which means you can book flight rewards for even fewer points.

- Get three free months of Uber Pass for discounts on rides, meals and more.

- Earn 1 Aeroplan point for every $6 spent on CIBC Global Money Transfer, with no transaction fees or interest as long as you pay your balance on time.

- Use the CIBC Pace It feature to make installment payments on large purchases.

- Four types of insurance are provided: car rental collision and loss damage insurance, purchase security and extended protection insurance, and common carrier travel accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, $15,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

Great for free checked bags

CIBC Aeroplan® Visa Infinite Card

-

Annual Fee$139Get a one-time annual fee rebate ($139) for you (the primary cardholder) and up to three authorized users ($50 each).Waived first year

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1x-1.5x Points1.5x on gas, groceries and direct Air Canada purchases, and 1x on all other purchases.

-

Intro OfferUp to 45,000 PointsEarn 10,000 Aeroplan points when you make your first purchase. Spend $1,000 or more during your first four monthly statement periods and earn another 35,000 points. Offer applies to new cardmembers only.

While it’s a little light on exclusive perks, the CIBC Aeroplan Visa Infinite card offers an interesting collection of benefits that should be more than enough to keep many users satisfied.

Pros

- An admirable amount of insurance coverage considering the card’s relatively low annual fee.

- Families can combine their Aeroplan points.

Cons

- Few opportunities to earn double points on purchases, even during the introductory period.

- Beyond the free first checked bag allowance and access to Visa Infinite’s lineup of food, beverage and luxury hotel offers, juicier travel perks are in short supply.

- Intro offer details: Earn 10,000 Aeroplan points when you make your first purchase. Spend $1,000 or more during your first four monthly statement periods and earn another 35,000 points. Offer applies to new cardmembers only.

- 1.5x Aeroplan points for every dollar spent on gas, groceries and direct Air Canada purchases, including Air Canada Vacations, up to a maximum annual spend of $80,000.

- 1x Aeroplan point for every dollar you spend on all other purchases.

- Earn points twice by providing your Aeroplan number at over 150 Aeroplan partners and more than 170 online retailers through the Aeroplan eStore.

- Points can be redeemed for flights, car rentals and hotel bookings, as well as merchandise and gift cards available in the Aeroplan eStore.

- $139 annual fee, which can be reduced each year if you have a CIBC Smart Plus account.

- Access to Visa Infinite offers, including exclusive benefits at luxury hotels, gourmet restaurants and wineries in British Columbia, Ontario and Sonoma Valley.

- Car rental discounts of up to 25% at participating Avis and Budget locations worldwide.

- The Aeroplan Family Sharing plan allows Aeroplan members in the same household to combine their points and speed up the delivery of their next flight reward.

- Primary cardholders hoping to reach Aeroplan Elite Status can receive 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $10,000 in eligible purchases.

- Access to CIBC Pace It, an installment plan designed to help you pay off large or unexpected purchases over time at a lower interest rate.

- 13 types of insurance provided, including 15-day travel medical benefits (three days if you’re 65 or older on your departure date) — worth up to $5 million in coverage per insured person.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. You must also be a Canadian resident of the age of majority in the province or territory where you live who has not declared bankruptcy in the last seven years.

Best CIBC Aeroplan card

CIBC Aeroplan® Visa Infinite Privilege Card

-

Annual Fee$599Enjoy an annual fee rebate every year for the primary cardholder of up to $139 if you have a CIBC Smart Plus™ Account.Annual fee rebate available

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1.25x-2x Points2x on Air Canada purchases, 1.5x on gas, grocery, travel and dining, and 1.25x on other purchases.

-

Intro OfferUp to 90,000 PointsYou’ll receive 20,000 Aeroplan points when you make your first purchase, another 40,000 points if you spend $3,000 or more during your first four monthly statement periods, and 30,000 more points as an additional anniversary bonus. This offer only applies to newly approved card accounts.

The CIBC Aeroplan Visa Infinite Privilege card is loaded with enough attractive features — solid travel perks, an annual Companion Pass, low interest rates on major purchases — to make the high cost of entry worth it for some consumers.

Pros

- A generous introductory offer.

- Lounge access and priority status for you and your fellow travellers can bring comfort and enhanced convenience to a long day of travel.

Cons

- A high annual fee and steep income requirements.

- Qualifying for the annual Companion Pass requires a level of spending some cardholders may not be on board with.

- Intro offer details: You’ll receive 20,000 Aeroplan points when you make your first purchase, another 40,000 points if you spend $3,000 or more during your first four monthly statement periods, and 30,000 more points as an additional anniversary bonus. This offer only applies to newly approved card accounts.

- 2x Aeroplan points on Air Canada purchases, including Air Canada Travel Vacations.

- 1.5x Aeroplan points on gas, groceries, travel and dining, up to annual $100,000 spend.

- 1.25x Aeroplan points on other purchases.

- Earn points twice by providing your Aeroplan number at over 150 Aeroplan partner brands and over 170 online retailers through the Aeroplan eStore.

- Points can be redeemed for flights, car rentals and hotel stays, as well as complete vacation packages like cruises and all-inclusive resort visits. Points can also be redeemed for gift cards and merchandise sold through the Aeroplan eStore.

- $599 annual fee, which can be reduced by up to $139 each year if you have a CIBC Smart Plus account.

- An annual Worldwide Companion Pass, worth up to $599, to any destination in the world that Air Canada flies when you spend $25,000 on your card.

- Exclusive access to Visa Infinite Luxury Hotel Program, Visa Infinite Dining Series and the Visa Infinite Wine Country Program.

- Reach Aeroplan Elite status sooner by earning 1,000 Status Qualifying miles and one Status Qualifying segment for every $5,000 you spend on eligible purchases.

- Save up to 25% on car rentals at participating Avis and Budget locations.

- Authorized users can access travel benefits when travelling without you by linking their Aeroplan number.

- Access to CIBC Pace It, an installment plan designed to help you pay off large or unexpected purchases over time at a lower interest rate.

- 13 types of insurance provided, including 31-day travel medical benefits (10 days if you’re 65 or older on your departure date) — worth up to $5 million in coverage per insured person.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, $150,000 (individual) or $200,000 (household) annual income is required. You must be a Canadian resident who has reached the age of majority in your province or territory and who hasn’t made a bankruptcy claim in the last seven years.

Best Aeroplan card for students

CIBC Aeroplan® Visa Card for Students

-

Annual Fee$0

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances (21.99% for Quebec residents).

-

Rewards Rate0.67x-1x Points1x per $1 spent on gas, groceries and Air Canada travel purchases, and 1x per $1.50 spent on all other purchases.

-

Intro Offer10,000 PointsEarn 10,000 Aeroplan points when you make your first purchase at any time with your card. New cardmembers only.

Credit card beginners can use the CIBC Aeroplan Visa Card for Students to accumulate travel rewards thanks to a solid earn rate and a generous welcome bonus.

Pros

- The welcome bonus has no strings attached or hoops to jump through — simply make a purchase a receive 10,000 Aeroplan points.

- Your Aeroplan membership will help you earn points twice as fast at Aeroplan partners and retailers in the Aeroplan eStore when you pay with your Aeroplan credit card.

Cons

- The higher 20.99% interest rate could be a problem for students learning how to use their first credit card.

- To get the best value, you’ll have to be loyal to Air Canada and the Aeroplan rewards program.

- 1x Aeroplan points per dollar on gas, groceries and Air Canada travel purchases, up to $40,000 annual spend.

- 1x Aeroplan points per $1.50 spent on all other purchases, including gas, groceries and Air Canada travel purchases that exceed the $40,000 threshold.

- Earn points twice at over 150 Aeroplan partners and 170+ online retailers through the Aeroplan eStore.

- Aeroplan Points never expire and can be redeemed for a variety of travel, merchandise, gift card, and other rewards offered by Aeroplan’s participating partners and suppliers.

- $0 annual fee.

- Get three free months of Uber Pass for discounts on rides, meals and more. Offer ends September 8, 2022.

- Earn 1 Aeroplan point for every $6 spent on CIBC Global Money Transfer, with no transaction fees or interest as long as you pay your balance on time. Offer ends June 30, 2022.

- Maximize your points by adding up to three additional cards and giving them to your spouse or other family members. Points can be shared with other Aeroplan members in your household.

- Earn points by using your CIBC Aeroplan Visa to automatically make recurring bill payments.

- Receive preferred pricing when paying for flights with your Aeroplan points.

- Save up to 25% on car rentals at participating Budget and Avis locations worldwide when paying with your card.

- Save up to 10 cents per litre at participating Chevron, Ultramar and Pioneer gas stations if you link your card with Journie Rewards.

- Use the CIBC Pace It feature to make installment payments on large purchases.

- Four types of insurance are provided: auto rental collision and loss damage insurance, purchase security, extended protection insurance, and $100,000 in common carrier accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, you must have full-time status in a college or university.

Best Aeroplan business credit card from CIBC

CIBC Aeroplan® Visa* Business Plus Card

-

Annual Fee$120Waived first year

-

Interest Rates19.99% / 22.99%19.99% on purchases, 22.99% on cash advances.

-

Rewards Rate1x-2x Points2x points on Air Canada purchases, including through Air Canada Vacations, 1.5x on shipping, internet, cable, phone services, travel and dining, and 1x on everything else.

-

Intro OfferUp to 60,000 PointsEarn 10,000 points after making the first purchase, 20,000 points by spending $3,000 during the first four months, and 30,000 points by spending $35,000 during the first year. Plus, an annual fee rebate for the first card and each additional cardholder. Earn an Air Canada Buddy Pass after spending $3,000 during the first four months, and enjoy a free first checked back for two travellers and Maple Leaf Lounge™ access.

In addition to a solid earn rate on Air Canada purchases, the CIBC Aeroplan Visa Plus card helps businesses earn Aeroplan points on items and services they’ll inevitably spend money on, like shipping, internet and phone services.

Pros

- Strong earn rates on Air Canada purchases and when buying common business items.

- Achievable bonuses, like an Air Canada Buddy Pass and 10,000 bonus points earned after your first purchase.

- Broad selection of travel insurance included, plus perks like four complimentary

- Maple Leaf Lounge™ One-Time Guest Passes per year.

Cons

- Smaller businesses may not spend enough to score the full 60,000 welcome bonus.

- Capitalizing on the highest earn rates won’t be possible if you don’t fly with Air Canada frequently.

- Intro offer: Earn 10,000 points after making the first purchase, 20,000 points by spending $3,000 during the first four months, and 30,000 points by spending $35,000 during the first year. Plus, an annual fee rebate for the first card and each additional cardholder.

- Receive an Air Canada Buddy Pass, good for a $0 base fare anywhere Air Canada flies in North America, when $3,000 is charged to the account in the first four monthly statement periods.

- Free first checked bag for two travellers for each flight when a round-trip Air Canada flight is taken in the first year.

- Maple Leaf Lounge access: up to four passes worth $25 each for every $10,000 in eligible spend.

- $120 annual fee — rebated in the first year.

- $50 annual fee for each additional card — first year rebate for up to three cards.

- Add up to 15 cardholders to consolidate business expenses and earn points faster.

- Earn 2 Aeroplan points for every dollar spent directly with Air Canada, including through Air Canada Vacations. After $80,000 in net annual card purchases, Aeroplan points are earned at the regular rate.

- Earn 1.5 Aeroplan points for every dollar spent on shipping, internet, cable, phone services, travel and dining.

- Earn 1 Aeroplan point for every dollar spent on all other purchases.

- Earn points twice at over 150 Aeroplan partners and more than 170 online retailers through the Aeroplan estore.

- Points can be redeemed for flights, hotel stays, car rentals, merchandise, gift cards and more.

- Book flight rewards using fewer points when booking through the Rewards Officer.

- Fraud alerts and zero liability protection if a card is stolen or used for fraudulent purchases.

- Travel insurance: trip cancellation insurance (up to $1,000 per insured person per trip to a maximum of $5,000), trip interruption/trip delay insurance (up to $2,000 per insured person per trip), flight delay insurance (up to $500 per occurrence), stolen/lost/delayed baggage insurance (up to $500 per insured person to a maximum of $1,000 per occurrence), car rental collision and loss damage insurance (on cars with a suggested retail price of less than $65,000), common carrier accident insurance (up to $500,000 per insured person), purchase security and extended warranty protection.

- Free Uber Pass for six months.

- Access to Visa Spend Clarity for Business, a web-based reporting solution for expense management.

- Preferred rates: 19.99% on purchases, 22.99% on cash advances.

Best credit cards to earn Aeroplan points

While these cards aren’t co-branded with Aeroplan, these transferrable rewards credit cards earn points you can convert to Aeroplan.

Best credit card with no pre-set spending limit + great for 1:1 point transfers

The Platinum Card® from American Express

-

Annual Fee$699

-

Interest RatesVariesThis card also has a Flexible Payment Option (FPO), which lets you carry a portion of your balance with interest on eligible purchases. Card members must pay all charges not included in their FPO balance in full.

-

Rewards Rate1x-3x Points3x on eligible dining in Canada, 2x on eligible travel and 1x on everything else.

-

Intro OfferUp to 80,000 PointsNew Platinum® Cardmembers, earn 60,000 Welcome Bonus points after you charge $6,000 in net purchases to your Card in your first 3 months of Cardmembership. Plus, earn 20,000 points when you make a purchase between 14 and 17 months of Cardmembership.

This precision-cut and engraved metal Platinum Card boasts a generous intro offer, strong earn rates on rewards, and an impressive array of premium benefits and perks.

Pros

- From special reservations to insider tips, you can enhance your travel experiences with complimentary, personalized service from Platinum Concierge — available 24/7.

- Benefit from a full suite of Platinum-level travel perks, such as worldwide airport lounge access, the Global Dining Collection, and more.

Cons

- Unless you plan to travel a lot, it may be difficult to offset the high $699 annual fee.

- No travel medical coverage for cardmembers over the age of 65.

- Unlock special experiences with the Platinum Card®.

- Earn up to 80,000 Membership Rewards® points – that’s up to $800 towards a weekend away.

- New Platinum® Cardmembers, earn 60,000 Welcome Bonus points after you charge $6,000 in net purchases to your Card in your first 3 months of Cardmembership.

- Plus, earn 20,000 points when you make a purchase between 14 and 17 months of Cardmembership.

- Earn 3 points for every $1 in Card purchases on eligible dining and food delivery in Canada, 2 points for every $1 in Card purchases on eligible travel, and 1 point for every $1 in all other Card purchases.

- You will have access to a $200 CAD Annual Travel Credit to use towards any single travel booking of $200 or more charged to your Platinum Card and made on www.americanexpress.ca/travel or through Platinum Card® Travel Service.

- Take full advantage of The American Express Global Lounge Collection™ which unlocks access to over 1,200 airport lounges worldwide. This includes The Centurion® Lounge network, Plaza Premium Lounges, and hundreds of other domestic and international lounges designed to enhance your travel experience.

- Enjoy flexible ways to use your points such as statement credits for any eligible purchase charged to your Card, new travel purchases booked on American Express Travel Online through the Flexible Points Travel Program, and eligible flights through the Fixed Points Travel Program.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- Enjoy complimentary benefits that offer an average value of $550 USD at over 1,000 extraordinary properties worldwide when you book Fine Hotels + Resorts.

- Platinum Cardmembers can enjoy access to special events and unique opportunities.

- Enjoy premium benefits at the Toronto Pearson Airport such as discount on parking.

- You will also have access to many leading hotel and car rental companies’ loyalty programs. Our partners include Marriott International, Hilton Hotels and Resorts, Radisson Hotel Group Americas, Hertz and Avis.

- Interest applies in accordance with your Cardmember Agreement, Information Box, and Disclosure statement if the total New Balance is not paid by the Payment Due Date each month. All payments must be received by the Payment Due Date shown on the monthly statement.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Great for 1:1 point transfers + our pick for travel perks and insurance benefits

American Express® Gold Rewards Card

-

Annual Fee$250

-

Interest Rates20.99% / 21.99%20.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1x-2x Points2x points on eligible travel purchases, 2x on eligible purchases at gas stations, grocery stores and drugstores in Canada, and 1x on purchases everywhere else.

-

Intro OfferUp to 50,000 PointsNew American Express® Gold Rewards Cardmembers can earn a Welcome Bonus of 40,000 points when you charge $3,000 in purchases to your Card in your first 3 months of Cardmembership. Plus, earn an additional 10,000 points when you make a purchase between 14 and 17 months of Cardmembership.

The American Express Gold Rewards Card should get the attention of travellers looking for comfort and flexibility. Points can be used for an impressive array of items and can be transferred to other rewards programs. The new rose gold design is an eye-catcher, too.

Pros

- Travel in comfort: room and rental car upgrades, access to airport lounges and credits for hotel amenities like dining and spa treatments.

- The 50,000-point intro offer is equivalent to $500 for shopping, travel and more.

Cons

- Travellers 65 or older won’t be covered by the card’s emergency medical insurance.

- If you travel often, you could burn through your four complimentary visits to Plaza Premium Lounges fairly quickly.

- Earn up to 50,000 Membership Rewards® points – that’s up to $500 towards your next flight or dinner out with friends.

- New American Express® Gold Rewards Cardmembers can earn a Welcome Bonus of 40,000 points when you charge $3,000 in purchases to your Card in your first 3 months of Cardmembership.

- Plus, earn an additional 10,000 points when you make a purchase between 14 and 17 months of Cardmembership.

- Earn 2 points for every $1 in Card purchases for eligible travel purchases, including flights, hotels, car rentals, cruises, and more.

- Earn 2 points for every $1 in Card purchases at eligible gas stations, grocery stores and drugstores in Canada, and 1 point for every $1 in Card purchases everywhere else.

- The Card is now available in your choice of Gold or Rose Gold metal options.

- Receive a $50 CAD statement credit when a NEXUS application or renewal fee is charged to your American Express Gold Rewards Card.

- You have access to an annual $100 CAD Travel Credit, compliments of your American Express Gold Rewards Card. Use the credit once annually towards any single travel booking of $100 or more charged to your Gold Rewards Card through American Express Travel Online.

- As a Gold Rewards Cardmember, you can receive complimentary membership in Priority PassTM – one of the world’s largest independent airport lounge programs. Escape the chaos of airports and relax in an oasis of calm and simply enjoy the fact that the travel experience has begun before your plane has even left the ground. Enrollment is required and entry fees apply.

- Enjoy four (4) complimentary visits per Calendar year to Plaza Premium Lounges across Canada. Entry fees apply once complimentary visits have been used.

- Charge any eligible purchase to your credit Card then log in to redeem your earned points for a statement credit.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- 1 Free Additional Gold Rewards Card (a $50 value) to help you earn points faster.

- Subject to approval. The preferred rate for purchases is 20.99% and funds advances is 21.99%. If you have Missed Payments, the applicable rates for your account will be 23.99% and/or 26.99%. See the information box included with the application for the definition of Missed Payment and which rates apply to charges on your account and other details.

- American Express is not responsible for maintaining of monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

- To be eligible, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

Best for fair credit + great for 1:1 point transfers

American Express Cobalt® Card

-

Annual Fee$155.88$12.99 monthly fee.

-

Interest Rates20.99% / 21.99%20.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1x-5x Points5x on eligible eats and drinks in Canada, including groceries and food delivery, 3x on on eligible streaming subscriptions in Canada, 2x on eligible transit & gas purchases in Canada and eligible travel purchases, and 1x on purchases everywhere else.

-

Intro OfferUp to 30,000 PointsIn your first year as a new Cobalt Cardmember, you can earn 2,500 Membership Rewards® points for each monthly billing period in which you spend $500 in net purchases on your Card (up to 30,000 points).

The American Express Cobalt Card boasts high rewards rates on everyday spending, a generous welcome bonus, comprehensive travel insurance coverage, flexible point redemption and plenty of specialty perks to keep things interesting all year long.

Pros

- Earn 150,000 points in the first year by spending up to $30,000 on eats, drinks and groceries. Combined with the 30,000 point intro offer, you could earn 180,000 points in your first year, which you could redeem for travel and more.

- Easily transfer the points you earn to popular airline and hotel loyalty programs, such as Aeroplan and Marriott Bonvoy.

Cons

- Airport lounge access isn’t provided, which may disappoint some frequent travellers.

- No travel medical coverage for cardmembers over the age of 65.

- In your first year as a new Cobalt Cardmember, you can earn 2,500 Membership Rewards® points for each monthly billing period in which you spend $500 in net purchases on your Card. This could add up to 30,000 points in a year. That’s up to $300 towards a weekend getaway or concert tickets.

- Earn 5x the points on eligible eats and drinks in Canada, including groceries and food delivery.

- Earn 3x the points on eligible streaming subscriptions in Canada.

- Earn 2 points for every $1 spent on eligible transit & gas purchases in Canada and eligible travel purchases. That’s 2X the points on purchases that get you from point A to B.

- Earn 1 point for every $1 in Card purchases everywhere else. We won’t tell you where to spend, we’ll just reward you on your Card purchases.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- Cobalt Cardmembers receive regular Perks such as bonus reward offers and access to great events.

- Access Front Of The Line® Presale & Reserved Tickets to some of your favourite concerts and theatre performances and special offers and events curated for Cardmembers with American Express® Experiences.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information and Terms and Conditions, click the Apply now link. Conditions Apply.

Best no-fee card for 1:1 point transfers + great for students and fair credit

American Express® Green Card

-

Annual Fee$0

-

Interest Rates20.99% / 21.99%20.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1x-2x Points2x on eligible hotel and car rental bookings, and 1x on all other eligible purchases.

-

Intro Offer10,000 PointsEarn 10,000 Membership Rewards points when you spend $1,000 in the first three months. New cardmembers only.

The American Express Green Card has a simple rewards program with an accelerated earn rate on hotel and rental car bookings, and it’s easy to transfer your points to other loyalty programs for maximum redemption value. Oh, and the card itself is made from 99% recycled plastic.

Pros

- No limits on rewards spending, and more ways to redeem your points than other no-fee rewards credit cards on this list.

- Cardholders who enjoy VIP treatment will enjoy access to a multitude of perks through American Express Experiences.

Cons

- Reward earn rates are lower than some other no-fee credit cards.

- Lacks some of the travel perks and insurance options offered by other cards.

- Get the Card that lets you live in the moment while getting ready for the future.

- The American Express® Green Card lets you go for it with every swipe or tap of your Card.

- As a new American Express® Green Cardmember, you can earn a Welcome Bonus of 10,000 Membership Rewards® points when you charge $1,000 in purchases to your Card in the first 3 months of Cardmembership. That’s $100 towards groceries or concert tickets.

- Earn 1x the points on Card purchases.

- Charge an eligible purchase to your Card and redeem your Membership Rewards points for a statement credit (All eligible purchases: 1,000 points = $10 statement credit).

- With American Express Experiences and Front Of The Line®, American Express Cardmembers get access to amazing events in Canada.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best hotel card for point transfers: 3 Marriott Bonvoy points = 1 Aeroplan point

Marriott Bonvoy® American Express®* Card

-

Annual Fee$120

-

Interest Rates19.99% / 22.99%19.99% for purchases, 21.99% for cash advances.

-

Rewards Rate2x-5x Points5x points every $1 in eligible Card purchases at hotels participating in Marriott Bonvoy®. 2x points for every $1 in all other Card purchases.*

-

Intro Offer50,000 PointsNew Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time.

The Marriott Bonvoy® American Express®* Card helps travellers earn free stays and experiences at some of the world’s ritziest hotels, restaurants and spas, while also providing helpful insurance options and flexibility in how Marriott Bonvoy® points can be used.

Pros

- Solid earn rates should help members of the Marriott Bonvoy® program score free hotel stays.

- Marriott Bonvoy® points can be transferred to frequent flyer miles with some airlines, including Air Canada’s Aeroplan.

- Access to American Express® Experiences and several varieties of insurance.

Cons

- You’ll need to be a Marriott Bonvoy® member to take advantage of the card’s most valuable benefits.

- American Express isn’t always as widely accepted as some other credit cards, so using the Marriott Bonvoy® American Express®* — and collecting points — everywhere you go might not always be possible.

- New Marriott Bonvoy® American Express®* Cardmembers earn 50,000 Marriott Bonvoy® points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership. Subject to change at any time

- Earn 5 points for every $1 spent in eligible Card purchases at hotels participating in Marriott Bonvoy®.

- Earn 2 points for every $1 spent in all other Card purchases.

- Receive an Annual Free Night Award for up to 35,000 points at eligible hotels and resorts worldwide every year after your first anniversary.

- No annual fee on Additional Cards.

- Redeem points for free nights with no blackout dates at over 7,000 of the world’s most desired hotels.

- Automatic Marriott Bonvoy Silver Elite status membership.

- Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy® American Express®* Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program.

- Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on the Card each year or when you combine 10 qualifying paid nights within one calendar year with the 15 Elite Night Credits from your card.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best business card for point transfers

Marriott Bonvoy®️ Business American Express®️* Card

-

Annual Fee$150

-

Interest Rates19.99% / 21.99%19.99% on purchases and 21.99% on funds advances.

-

Rewards Rate2x-5x Points5 points per $1 at participating Marriott Bonvoy hotels. 3 points per $1 on eligible gas, dining, and travel purchases, 2 points per $1 on all other purchases.

-

Intro Offer50,000 PointsEarn 50,000 Welcome Bonus Marriott Bonvoy points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership.

The Marriott Bonvoy® Business American Express®* Card makes it easy to accumulate points, with accelerated rates on travel, dining and gas. Marriott Bonvoy points can be redeemed for a variety of rewards. A generous welcome offer sweetens the deal.

Pros

- Accelerated points for hotel, gas, dining and travel spending.

- Business account management tools.

- Low annual fee.

Cons

- Lacks premium travel perks, like lounge access and priority boarding.

- Earn 5 points for every $1 in Card purchases at properties participating in Marriott Bonvoy.

- Earn 3 points for every $1 in Card purchases on eligible gas, dining and travel.

- Earn 2 points for every $1 on all other purchases.

- Earn 50,000 Welcome Bonus Marriott Bonvoy points after you charge $1,500 in purchases to your Card in your first three months of Cardmembership.

- Travel Emergency Assistance – Provides out-of-town emergency medical and legal referrals by telephone, 24 hours a day, 7 days a week.

- Travel Accident Insurance provides automatic coverage of up to $500,00 of Accidental Death and Dismemberment Insurance when you fully charge your common carrier (plane, train, ship or bus) tickets to your Marriott Bonvoy™ Business American Express® Card.

- Cardmembers can purchase Front Of The Line presale tickets or make Front Of The Line reservations to some of the most in-demand concerts, theatre productions, restaurants and special events, often before the general public.

Methodology to identify the Aeroplan credit cards

NerdWallet Canada selects the best Aeroplan credit cards based on overall consumer value as well as their suitability for specific kinds of consumers. Factors in our evaluation methodology include each card’s earning rates, rewards structure (such as flat-rate or bonus categories), annual fee, redemption options, promotional APR period for purchases, bonus offers for new cardholders, and noteworthy features such as insurance, loyalty bonuses or the ability to choose one’s own rewards categories.

Summary of the best Aeroplan credit cards:

| Card Name | Why we picked it | Annual Fee | Intro offer |

|---|---|---|---|

| American Express® Aeroplan®* Reserve Card | Robust travel insurance plus unlimited rewards | $599 | Up to 85,000 Points |

| The Platinum Card® from American Express | Metal card with enhanced travel experiences | $699 | Up to 80,000 Points |

| TD® Aeroplan® Visa Infinite Card | Low annual fee coupled with luxurious travel perks | $139 | Up to 55,000 Points |

| American Express® Aeroplan®* Card | Accelerated earn rates on Air Canada purchases | $120 | Up to 50,000 Points |

| American Express® Gold Rewards Card | Metal card with plenty of travel perks | $250 | Up to 50,000 Points |

| American Express Cobalt® Card | Low-fee card with flexible point redemption | $155.88 | Up to 30,000 Points |

| American Express® Green Card | No annual fee and point transfers to other programs | $0 | 10,000 Points |

| TD® Aeroplan® Visa Infinite Privilege Card | Tons of airport perks and comprehensive travel insurance | $599 | Up to 115,000 Points |

| TD® Aeroplan® Visa Platinum Credit Card | Low annual fee plus travel insurance | $89 | Up to 20,000 Points |

| Marriott Bonvoy® American Express® Card | Earn free experiences at hotels, restaurants and spas | $120 | 50,000 Points |

| American Express® Aeroplan®* Business Reserve Card | Strong earn rates with business management tools | $599 | Up to 85,000 Points |

| CIBC Aeroplan® Visa Infinite Privilege Card | Generous welcome offer and luxurious travel perks | $599 | Up to 90,000 Points |

| CIBC Aeroplan® Visa Infinite Card | Air Canada perks and comprehensive insurance | $139 | Up to 45,000 Points |

| CIBC Aeroplan® Visa Card | Comprehensive insurance coverage with no annual fee | $0 | 10,000 Points |

| CIBC Aeroplan® Visa Card for Students | No-fee card with a solid earn rate | $0 | 10,000 Points |

| CIBC Aeroplan® Visa* Business Plus Card | Enhanced Air Canada business travel | $120 | Up to 60,000 Points |

| TD® Aeroplan® Visa* Business Card | Increased earn rate on business spending with solid insurance coverage | $149 | Up to 60,000 Points |

| Marriott Bonvoy®️ Business American Express®️* Card | Strong earn rates and business account tools | $150 | 50,000 Points |

| American Express®* Aeroplan® Corporate Reserve Card | Luxurious travel rewards and insurance coverage | $699 | N/A |

Best Credit Cards in Canada

Compare all different credit cards side-by-side and find out the best card that will meet your need with special perks and benefits

Guide to Aeroplan credit cards and rewards in Canada

By Barry Choi and Shannon Terrell

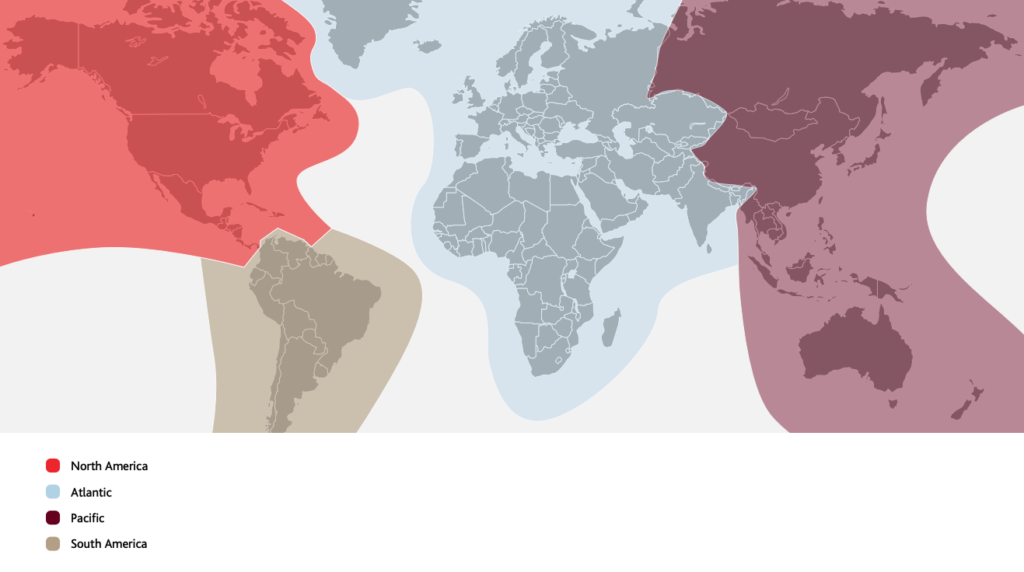

Aeroplan credit cards are rewards cards that earn Aeroplan points. These points are specific to Air Canada’s loyalty program, but since Aeroplan has more than 50 airline partners, you’re not restricted to using your points just on Air Canada flights. In addition, you can use your points on hotels, car rentals and even merchandise.

- What is an Aeroplan credit card?

- Is an Aeroplan credit card worth it?

- Types of Aeroplan credit cards

- Co-branded Aeroplan cards vs. transferable rewards cards

- How to get an Aeroplan credit card

- How to choose the best Aeroplan credit card

- How to use your Aeroplan credit card

- How the Aeroplan rewards program works

- Aeroplan points value

- How to earn Aeroplan points

- How to redeem Aeroplan points

- How to get the best value for Aeroplan redemptions

What is an Aeroplan credit card?

Aeroplan credit cards work like other Canadian credit cards but earn Aeroplan points.

Aeroplan has partnered with multiple financial institutions and offers co-branded Aeroplan credit cards to the public. While every Aeroplan credit card allows you to earn Aeroplan points, there are typically some minor differences, including:

- Annual fee.

- Welcome bonus.

- Earn rate.

- Insurance.

- Benefits specific to Air Canada.

- Travel perks.

- Additional benefits.

Primary cardholders will get access to all of their Aeroplan credit card features. Some benefits, such as travel insurance and checked bags, can be shared by any travelling companions on the primary cardholder’s itinerary. Occasionally, supplementary cardholders can also enjoy the card’s benefits even if they’re not travelling with the primary cardholder.

The benefits don’t carry over if an Aeroplan credit cardholder uses their card to purchase a ticket for someone else. For example, your parents won’t get free checked bags, even if you paid for their ticket with an Aeroplan credit card that offers the benefit.

Is an Aeroplan credit card worth it?

If you like to travel, there are many reasons to get an Aeroplan credit card.

- Air Canada is Canada’s largest airline, so it may be easier to find a route to your final destination.

- There are only a few ways for you to earn Aeroplan points without a co-branded Aeroplan card — and none of them are as easy as earning points on every purchase.

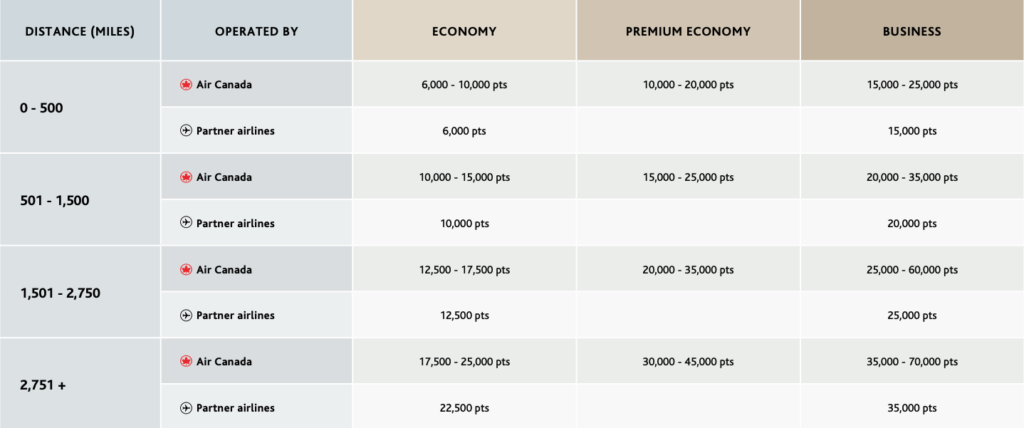

- Many Aeroplan credit cards come with generous welcome bonuses. For example, you might get 50,000 Aeroplan points after meeting the minimum spend requirement. That’s enough points for multiple round-trip flights within North America, depending on the distance.

- Aeroplan credit cards come with Air Canada-specific benefits, like free checked bags, access to Maple Leaf Lounges, and priority check-in and boarding.

- Depending on the card, you may also get travel insurance, mobile device insurance, purchase security and an extended warranty.

If you fly Air Canada regularly, or want to earn points for travel discounts, an Aeroplan credit card may be a practical choice.

Aeroplan vs. Air Miles

The Aeroplan and Air Miles programs earn points that can be redeemed for numerous perks, including flight tickets, car rentals, vacation packages, merchandise, gift cards and more.

When comparing your card options, consider these differences:

| Aeroplan | Air Miles | |

|---|---|---|

| Number of available credit cards | 13 | 7 |

| Credit card issuers | ||

| Credit card networks | ||

| Number of partner airlines | 51 | 20 |

| Average value per point, according to NerdWallet analysis | 2.23 cents | 11.35 cents |

| Special perks | Air Canada benefits, including free checked bags, priority boarding, lounge access, and eUpgrades. | 25% discount on flights (conditions apply), free Boingo Wi-Fi around the world with select Air Miles Mastercard credit cards. |

| Co-branded cardholder benefits | Higher earn rate on Air Canada purchases and Preferred Pricing discounts on flights. | Earn Miles twice at participating AIR MILES partners. |

| Are points transferable to other loyalty programs? | Yes. | No. |