Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

According to J.D. Power’s Canada Credit Card Satisfaction study, 22% of credit card holders made the switch to a no-fee card in 2021. The study also found that no-fee cardholders were more satisfied with their card issuer than those still paying an annual fee.

No-fee credit cards have lots to offer, including valuable rewards, impressive perks, low interest rates, and more — all without the burden of a yearly fee.

Our list of the best no-fee credit cards in Canada includes cards across numerous categories so you can choose the best one for your lifestyle and financial goals.

Best no-fee credit cards in Canada

Best no-fee secured card

Neo Card™ (Secured)

-

Annual Fee$0

-

Interest Rates19.99%-26.99%Interest rates range from 19.99%-26.99%. The standard rate on purchases and cash advances is dependent on Neo Financial’s assessment of your credit application, credit profile, and your province.

-

Min. Deposit$50

-

Maximum Deposit$10,000

-

Our TakeThe Neo Card™ (Secured) is a no-fee card that earns cash back rewards and offers access to high-interest savings.

Pros- A small $50 minimum deposit makes this card accessible to consumers of all budgets.

- Earn up to 15% cash back on purchases with select Neo partners.

Cons- Interest rates could be as high as 26.99% for some users.

- While Neo plans to report card activity to TransUnion, the company has confirmed that this function isn't fully operational yet, so the credit-building benefits of this card will be delayed.

-

Product Details

- Earn a 0.5% cash back guarantee, an average of 5% unlimited cash back at thousands of Neo partners, and up to 15% cash back on your first purchase at participating partners.

- No annual fee for the Standard rewards plan.

- $50 minimum security fund deposit required.

- $10,000 maximum security fund deposit.

- To apply, visit member.neofinancial.com and create an account. Select “Credit”, pick either the Neo Card™ or the Hudson’s Bay Mastercard, and then choose “Secured Card” as the type of credit you are looking for.

- Hard credit checks are not made on applications.

- Guaranteed approval, as long as you meet eligibility requirements.

- Ability to upgrade to an unsecured rewards credit card.

- Link your account to a Neo Money™ account and earn 2.25% interest on savings.

- Purchase rates range from 19.99%-26.99%. The standard rate on purchases and cash advances is dependent on Neo Financial’s assessment of your credit application, credit profile, and your province.

- To be eligible, you must be able to provide security funds and be a Canadian resident of the age of majority in the province or territory where you live.

Best no-fee American Express card

American Express® Green Card

-

Annual Fee$0

-

Interest Rates20.99% / 21.99%20.99% on purchases, 21.99% on cash advances.

-

Rewards Rate1x-2x Points2x on eligible hotel and car rental bookings, and 1x on all other eligible purchases.

-

Intro Offer10,000 PointsEarn 10,000 Membership Rewards points when you spend $1,000 in the first three months. New cardmembers only.

-

Our TakeWhy we like it

The American Express Green Card has a simple rewards program with an accelerated earn rate on hotel and rental car bookings, and it’s easy to transfer your points to other loyalty programs for maximum redemption value. Oh, and the card itself is made from 99% recycled plastic.

Pros- No limits on rewards spending, and more ways to redeem your points than other no-fee rewards credit cards on this list.

- Cardholders who enjoy VIP treatment will enjoy access to a multitude of perks through American Express Experiences.

Cons- Reward earn rates are lower than some other no-fee credit cards.

- Lacks some of the travel perks and insurance options offered by other cards.

-

Product Details

- Get the Card that lets you live in the moment while getting ready for the future.

- The American Express® Green Card lets you go for it with every swipe or tap of your Card.

- As a new American Express® Green Cardmember, you can earn a Welcome Bonus of 10,000 Membership Rewards® points when you charge $1,000 in purchases to your Card in the first 3 months of Cardmembership. That’s $100 towards groceries or concert tickets.

- Earn 1x the points on Card purchases.

- Charge an eligible purchase to your Card and redeem your Membership Rewards points for a statement credit (All eligible purchases: 1,000 points = $10 statement credit).

- With American Express Experiences and Front Of The Line®, American Express Cardmembers get access to amazing events in Canada.

- Transfer points 1:1 to several frequent flyer and other loyalty programs.

- American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Best no-fee points card + our pick for the best no-fee Mastercard

MBNA Rewards Platinum Plus® Mastercard®

-

Annual Fee$0

-

Interest Rates19.99% / 24.99%19.99% on purchases, 24.99% on cash advances.

-

Rewards Rate1x-4x PointsEarn 4 points†† for every $1 spent on eligible restaurant, grocery, digital media, membership and household utility purchases during the first 90 days, and 2 points‡ for every $1 spent on eligible purchases in those categories thereafter – in both cases, these earn rates apply until $10,000 is spent annually in the applicable category. 1 point‡ for every $1 spent on all other eligible purchases.

-

Intro OfferUp to 10,000 PointsEarn 5,000 bonus points†† ($25 in cash back value) after you make $500 or more in eligible purchases within the first 90 days of your account opening. Earn 5,000 bonus points††($25 in cash back value) once enrolled for paperless e-statements within the first 90 days of account opening.

-

Our TakeWhy we like it

The MBNA Rewards Platinum Plus Mastercard offers bonus rewards on common spending categories, along with flexible options for redemption.

Pros- Flexible redemption options, including cash back, brand-name merchandise, gift cards, charitable donations and travel, and points never expire.

- You can receive up to 10,000 Birthday Bonus Points every year.

Cons- Accelerated earn rate drops to 2x after the first 90 days, and 1x after $10,000 in spending. Considering how many categories fit into the cap, hitting the limit will be easy for families and big spenders.

- Lack of travel insurance may disappoint some cardholders.

-

Product Details

- Earn 4 points†† for every $1 spent on eligible restaurant, grocery, digital media, membership and household utility purchases during the first 90 days, and 2 points‡ for every $1 spent on eligible purchases in those categories thereafter – in both cases, these earn rates apply until $10,000 is spent annually in the applicable category.

- Earn 1 point‡ for every $1 spent on all other eligible purchases.

- 5,000 bonus points†† ($25 in cash back value) after you make $500 or more in eligible purchases within the first 90 days of your account opening.

- 5,000 bonus points††($25 in cash back value) once enrolled for paperless e-statements within the first 90 days of account opening.

- Each year, you will receive Birthday Bonus Points‡ equal to 10% of the total number of Points earned in the 12 months before the month of your birthday, to a maximum Birthday Bonus each year of 10,000 Points.

- Redeem points‡ for cash back, brand-name merchandise, gift cards from participating retailers, charitable donations, and travel.

- Mobile Device Insurance*** With Mobile Device Insurance, you’ve got up to $1,000 in coverage for eligible mobile devices in the event of loss, theft, accidental damage or mechanical breakdown.

- No annual fee.

- ‡, ††, ✪, ***, Terms and Conditions apply.

- This offer is not available for residents of Quebec.

- Sponsored advertising. MBNA is a division of The Toronto-Dominion Bank (TD) and TD is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete information on this MBNA credit card, please click on the "Apply Now" button.

Best no-fee AIR MILES card

BMO AIR MILES®† Mastercard®*

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% on purchases and 22.99% on cash advances (21.99% for Quebec residents).

-

Rewards Rate0.04x-0.12x MilesEarn 3x the Miles for every $25 spent at participating AIR MILES Partners and 2x the Miles for every $25 spent at any eligible grocery store*. Earn 1 Mile for every $25 spent everywhere else.*

-

Intro Offer800 MilesSpend $1,000 in the first three months to earn 800 AIR MILES Bonus Miles (applications must be received by July 31, 2023 to be eligible). New accounts only. Terms and conditions apply.

-

Our TakeWhy we like it

It's rare to find a 0.99% balance transfer offer on a dedicated travel rewards credit card, especially with a low 2% balance transfer fee. Sure, the introductory period is only for nine months, but the BBMO AIR MILES®† Mastercard®* makes it worth its while by adding an extra introductory perk: 800 bonus AIR MILES.

Pros- No annual fee.

- Ability to earn unlimited rewards.

Cons- The introductory APR period for transfers is only nine months, so make sure you can pay off your balance during that window of time.

-

Product Details

- Welcome offer: Get 800 AIR MILES Bonus Miles!* That’s enough for $80 towards purchases with AIR MILES Cash.*

- Get a 0.99% introductory interest rate on Balance Transfers for 9 months, 2% fee applies to balance amounts transferred.*

- Get 3x the Miles for every $25 spent at participating AIR MILES Partners and 2x the Miles for every $25 spent at any eligible grocery store.*

- Get 1 Mile for every $25 spent everywhere else.*

- Use your BMO AIR MILES Mastercard and AIR MILES Collector Card at an AIR MILES Partner to earn Reward Miles from both.*

- No annual fee.*

- Receive a discount on car rentals.*

- Extended Warranty.*

- Purchase Protection.*

- *Terms and conditions apply.

- BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

Best no-fee prepaid card

KOHO Standard Prepaid Mastercard

-

Annual Fee$0

-

Rewards Rate0.5%-6%Up to 6% at select KOHO partners. 0.5% on everything else.

-

Min. Deposit$0No minimum purchase amount required.

-

Maximum Deposit$200,000KOHO Maximum Card Balance Limit for KOHO users who have opted into earning interest is $200,000. For users who have not opted into earning interest, the maximum card balance is $40,000.

-

Intro OfferN/A

-

Our TakeWhy we like it

KOHO offers two tiers of prepaid cards: a standard card and a premium card. Both combine the benefits of a debit card and a credit card with cash back rewards, limited fees and the ability to build credit. Plus, KOHO doesn’t charge interest — instead, they let you earn interest on every dollar you save in your KOHO account.

Pros- An app that tracks your spending, helps with budgeting, offers free financial coaching, and the ability to earn 1.2% interest on your entire account.

- Access to a credit building service that reports your payments for only $10 per month — a rare feature for a prepaid card.

Cons- KOHO is a tech-focused company, so if you’re uncomfortable with digital banking, it may not be the right choice.

- KOHO isn’t a credit card, which means you can’t borrow any money. You can only access the funds already in your account.

-

Product Details

- Up to 5% cash back at select KOHO Partners.

- 0.5% cash back on all purchases.

- Cash back is instantly added to your KOHO Savings account.

- $0 annual fee.

- Choose from one of four card colours.

- Receive both a physical and virtual card. For new users, you can start adding funds and shopping online while you wait for your physical card to arrive in the mail. No need to budge from your couch to make online Purchases! Just use your virtual card instead of getting up to find your wallet. Plus, it uses a different card number to help protect your physical card number when you’re shopping or booking services online.

- Add your KOHO card to Apple, Samsung or Google Pay.

- Access your payroll up to 3 days early with the Early Payroll feature.

- Automate your savings with Goals and RoundUps. Rounding up every Purchase lets you stash away some savings, while Goals make it easier to save for whatever it is that makes you happy.

- Lock in savings with Vault that keeps the funds you don’t want to spend separate from your spendable balance.

- Create custom budgets and track your spending habits. Know where you're at in real time with instant notifications every time you spend.

- To be eligible, you must be a Canadian resident of the age of majority in the province or territory where you live.

Best no-fee card for newcomers to Canada

Scotia Momentum® No-Fee Visa* card

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% for purchases, 22.99% for cash advances.

-

Rewards Rate0.5%-1%Earn 1% cash back on all eligible gas stations, grocery stores, drug stores purchases and recurring payments. Earn 0.5% cash back on all other eligible purchases.

-

Intro OfferUp to $100Earn 5% cash back on all purchases for the first 3 months (up to $2,000 in total purchases). Must open a new account by April 30, 2023.

-

Our TakeWhy we like it

The Scotia Momentum No-Fee Visa Card doesn’t provide any bells or whistles, but it also doesn’t charge an annual fee, making it an option for people looking to build credit while earning cash back on everyday purchases.

Pros- No annual fee.

- Benefit from a 0% introductory interest rate on balance transfers for the first 6 months (22.99% after that).

- Earn up to 1% cash back on eligible purchases and recurring bill payments.

- Opportunity to earn 5% cash back for a limited time with new cards opened by April 30, 2023.

Cons- No premium perks or benefits.

- The balance transfer promotional period cannot be used to transfer a balance from another Scotiabank Account.

-

Product Details

- Earn 5% cash back on all purchases for the first 3 months (up to $2,000 in total purchases) Plus get a 0.00% introductory interest rate on balance transfers for the first 6 months (22.99% after that, annual fee $0) Offer ends April 30, 2023.

- No annual fee.

- Earn 1% cash back on all eligible gas stations, grocery stores, drug stores purchases and recurring payments.

- Earn 0.5% cash back on all other eligible purchases.

- Save up to 25% off base rates at participating AVIS locations and at participating Budget locations in Canada and the U.S.

- Preferred rates: 19.99% on purchases, 22.99% on cash advances.

- To be eligible, $12,000 (individual) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident that is the age of majority in the province or territory where you live.

- Terms and Conditions Apply. Click 'Apply Now' for complete details.

Best no-fee card for fair credit + our pick for balance transfers

Tangerine Money-Back Credit Card

-

Annual Fee$0

-

Interest Rates19.95%19.95% on purchases and cash advances.

-

Rewards Rate0.5%-15%15% intro offer, 2% unlimited cash back on up to three categories. 0.50% unlimited cash back on everything else.

-

Intro OfferUp to $150Apply for a Tangerine Money-Back Credit Card by January 31, 2023 and earn an extra 15% back* on up to $1,000 in everyday purchases made within your first 2 months.

-

Our TakeWhy we like it

You can earn unlimited cash back at a 2% rate in up to three categories of your choice — all while earning 0.50% back on everything else.

Pros- You can tailor the 2% rewards to your spending by choosing up to three categories from Tangerine’s list of 10, which includes basics like gas and groceries as well as unusual picks like furniture and home improvement.

- Transfer balances within your first 30 days and pay only 1.95% interest on the transferred balance for the first six months (19.95% after that).

Cons- 2% cash back is a competitive rate, but many cards offer double the rewards on specific categories.

- Tangerine is a virtual bank with no physical bank branches.

-

Product Details

- 2% on two categories of your choice: grocery, furniture, restaurants, hotel-motel, gas, recurring bill payments, drug store, home improvement, entertainment, or public transportation and parking.

- Get a third cash-back category by choosing to have your rewards deposited into a Tangerine Savings Account.

- 0.50% on everything else.

- Redeem cash back monthly as a statement credit or deposited into a Tangerine Savings Account.

- No annual fee.

- Transfer balances within your first 30 days and pay only 1.95% interest on the transferred balance for the first six months (19.95% after that). 1% balance transfer fee applies to the amount transferred.

- Get free cards for any authorized users on your account.

- It only includes purchase assurance and extended protection insurance. For more insurance, consider the Tangerine World Mastercard which requires a minimum personal income of $60,000. If you meet this requirement, you will automatically be considered for the World card if you apply for the Money-Back card.

- Preferred rates: 19.95% for purchases and cash advances.

- To be eligible, a $12,000 (individual) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

Best no-fee card for gas and groceries + our pick for no foreign transaction fees + our pick for Scene+ points

Scotiabank Red American Express® Card

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% for purchases, 22.99% for cash advances.

-

Rewards Rate1x-3x PointsEarn 3X Scene+ points for each dollar charged to your account on all eligible purchases¹ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op. Earn 2X Scene+ points for every $1 CAD spent on eligible grocery stores, restaurants, fast food, and drinking establishments. Includes popular food delivery and food subscriptions. Earn 2X Scene+ points for every $1 CAD spent on eligible entertainment, including movies, theatres and ticket agencies Earn 2X Scene+ points for every $1 CAD spent on eligible gas and daily transit. Includes rideshare, buses, taxis, subway, and more. Earn 2X Scene+ points for every $1 CAD spent on eligible select streaming services. Earn 1X Scene+ point for every $1 spent on every other purchase.

-

Intro OfferUp to 12,000 PointsTo qualify for the 12,000 bonus Scene+ points offer: 1. Earn 7,000 bonus Scene+ points by making at least $750 in everyday eligible purchases in your first 3 months. 2. Plus, for a limited time, you are eligible to earn a 5,000 Scene+ point bonus when you spend at least $5,000 in everyday eligible purchases in your first year. Offer Ends April 30, 2023.

-

Our TakeWhy we like it

Use the Scotiabank American Express® Card to earn flexible Scene+ point rewards on everyday spending categories and redeem rewards for travel, entertainment and more.

Pros- Great earn rates on everyday purchases.

- Includes mobile device insurance.

- Enjoy special offers, experiences and more with American Express Invites.

Cons- Insurance is limited to mobile device insurance and purchase security & extended warranty protection.

-

Product Details

- Earn up to 12,000 bonus Scene+™ points in your first year (that's up to $120 towards travel) - Offer ends April 30, 2023.

- Earn 2X Scene+ points for every $1 CAD spent on eligible grocery stores, restaurants, fast food, and drinking establishments. Includes popular food delivery and food subscriptions.

- Earn 2X Scene+ points for every $1 CAD spent on eligible entertainment, including movies, theatres and ticket agencies.

- Earn 2X Scene+ points for every $1 CAD spent on eligible gas and daily transit. Includes rideshare, buses, taxis, subway, and more.

- Earn 2X Scene+ points for every $1 CAD spent on eligible select streaming services.

- Earn 1X Scene+ point for every $1 spent on every other purchase.

- You’ll earn 3X Scene+ points for each dollar charged to your account on all eligible purchases¹ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

- Scene+ points can be redeemed for travel purchase, merchandise and other non-travel rewards such as gift cards and prepaid cards.

- No annual fee.

- Enjoy Special Offers, Access and Experiences with American Express Invites®.

- To be eligible, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- Terms and Conditions Apply. Click 'Apply Now' for complete details.

Best no-fee card with low interest rates

MBNA True Line® Mastercard® credit card

-

Annual Fee$0

-

Interest Rates12.99% / 24.99%12.99% on purchases, balance transfers and access cheques. 24.99% on cash advances.

-

Rewards RateN/A

-

Intro OfferN/A

-

Our TakeWhy we like it

With a strong intro offer, no annual fee and a low interest rate of 12.99%, the MBNA True Line Mastercard is an affordable, no-frills way to transfer balances, pay for purchases and build credit.

Pros- Interest-free balance transfers for a full year.

- Save money while building credit with the no-fee credit card.

Cons- Higher interest rate compared to the 8.99% offered on the MBNA True Line® Gold Mastercard®, which charges an annual fee.

- Few extra benefits and no rewards program.

-

Product Details

- No annual fee.

- Standard Annual Interest Rates of 12.99% on eligible purchases, 12.99% on balance transfers✪, and 24.99% on cash advances.

- You could get a 0% promotional annual interest rate (“AIR”)† for 12 months on balance transfers✪ completed within 90 days of account opening.

- Around-the-clock fraud protection.

- Use available credit on your credit card to transfer funds right to your chequing account.

- †, ✪, Terms and Conditions apply.

- This offer is not available for residents of Quebec.

- Sponsored advertising. MBNA is a division of The Toronto-Dominion Bank (TD) and TD is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete information on this MBNA credit card, please click on the "Apply Now" button.

Best no-fee cash back business card

TD Business Cash Back Visa* Card

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% for purchases, 22.99% for cash advances.

-

Rewards Rate0.50%-2%2% on eligible Office Supply Purchases and Gas Purchases (up to a $15,000 maximum annual spend), 2% on regularly recurring bill payments (up to a $15,000 maximum annual spend), and 0.50% on everything else.

-

Intro OfferN/A

-

Our TakeWhy we like it

The TD Business Cash Back Visa* Card is a no-fee card that earns competitive rewards on office supplies, gas, and recurring bills.

Pros- Earn competitive rewards on business essentials.

Cons- Accelerated earn rates for bonus category spending are restricted to $15,000 maximum annual spending limits.

-

Product Details

- $0 annual fee.

- 2% cash back on eligible Office Supply Purchases and Gas Purchases (up to a $15,000 maximum annual spend).

- 2% cash back on regularly recurring bill payments (up to a $15,000 maximum annual spend).

- 0.50% cash back on everything else, including after you’ve exceeded your annual spending limits in bonus categories.

- 19.99% for purchases, 22.99% for cash advances.

- Earn 50% more Stars at participating Starbucks stores. Conditions apply.

- Cash Back Dollars never expire as long as your account is open and in good standing. Rewards are credited back to your business account as an automatic statement credit on an annual basis.

- Get access to the Card Management Tool, an easy way to access online reporting, review your business expenses, manage your existing credit limits, and apply spend controls.

- Discounts of up to 25% off for business purchases made under the Visa SavingsEdge Program.

- Save with Avis Rent A Car and Budget Rent A Car.

- Chip & PIN technology, Verified by Visa, plus Purchase Security and Extended Warranty Protection.

- Access to optional Travel Medical Insurance, Trip Cancellation and Trip Interruption Insurance.

- Optional TD Auto Club Membership.

- Emergency cash advances available, up to $5,000 for your TD Business Cash Back Visa* Card.

- Eligibility requirements: You are a Canadian resident and are of the age of majority in your province/territory of residence.

Best overall no-fee card + our pick for students and cash back

Simplii Financial™ Cash Back Visa Card

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% on purchases, 22.99% on cash advances.

-

Rewards Rate0.5%-10%10% intro offer. 4% at restaurants, bars and coffee shops, 1.5% on gas, groceries, drugstores and pre-authorized payments, and 0.5% on everything else.

-

Intro OfferUp to $50Earn 10% bonus cash back at restaurants and bars in your first four months (up to $50).

-

Our TakeWhy we like it

The $0-annual-fee Simplii Financial Cash Back Visa Card earns bonus cash-back on the purchases you make almost every day.

Pros- New cardmembers can earn a 9.99% introductory annual interest on purchases for the first six months.

Cons- The 0.5% base rate isn’t exactly impressive, but it only applies after you hit the annual spending limits of bonus categories.

- It only includes purchase security and extended protection insurance.

-

Product Details

- 4% on restaurant, bar and coffee shops, up to $5,000 per year.

- 1.5% on gas, groceries, drugstores and pre-authorized payments, up to $15,000 per year.

- 0.5% on everything else.

- Plus, for your first 4 months, enjoy 10% bonus cash back at restaurants and bars up to $500 spend. Get 4% cash back after that.

- Redeem cash back as a statement credit in December.

- No annual fee.

- Cash back when you send money abroad with a Simplii Financial Global Money Transfer. No transaction fees and no interest charges.

- Purchase security and extended protection insurance provided.

- Preferred rates: 19.99% for purchases, 22.99% for cash advances.

- To be eligible, a $15,000 (individual) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident (excluding Quebec) that is the age of majority in the province or territory where you live.

Best no-fee business card + our pick for business travel

BMO® AIR MILES®† No-Fee Business® Mastercard®*

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% on purchases, 22.99% on cash advances.

-

Rewards Rate0.05x-0.06x MilesEarn 1 Mile for every $20 spent. Earn 1.25x Miles for every $20 spent at participating Shell stations.

-

Intro Offer1,000 MilesEarn 1,000 Bonus Miles when you spend $3,000 in net card purchases in the first three months from account open date. Offer expires December 31, 2023.

-

Our TakeWhy we like it

Not many no-fee cards allow users to earn AIR MILES, which makes the BMO AIR MILES No-Fee Business Mastercard a unique and rewarding option.

Pros- Get up to 22 additional cards, and enjoy protection against misuse with the Liability Waiver Program.

- Enjoy automatic rebates of up to 25% when shopping at qualifying merchants with Mastercard Easy Savings.

- Flexibility in how AIR MILES can be redeemed, and the ability to earn extra Miles when shopping at Shell gas stations

Cons- Few additional perks.

- No travel insurance offered.

- The earn rates may not impress experienced AIR MILES collectors.

-

Product Details

- Intro offer: earn 1,000 AIR MILES by spending $3,000 in net card purchases during the first three months.

- Earn 1 AIR MILE for every $20 spent.

- Earn 1.25x AIR MILES for every $20 spent at participating Shell stations.

- No annual fee.

- Get up to 22 additional cards to earn points faster.

- AIR MILES can be redeemed for travel, office supplies, events, attractions or cash rewards.

- Mastercard Easy Savings: Automatic rebates of up to 25% when shopping at qualifying merchants.

- 90-day purchase protection and extended warranty protection of up to one additional year on items charged to the card.

- Liability Waiver program: get protection against employee card abuse.

- Preferred rates: 19.99% on purchases, 22.99% on cash advances.

Best no-fee travel card + best no-fee intro offer + our pick for a no-fee airline card

CIBC Aeroplan® Visa Card

-

Annual Fee$0

-

Interest Rates20.99% / 22.99%20.99% on purchases, 22.99% on cash advances (21.99% for Quebec residents).

-

Rewards Rate0.67x-1x Points1x per $1 spent on gas, groceries and Air Canada travel purchases, and 1x per $1.50 spent on all other purchases.

-

Intro Offer10,000 PointsEarn 10,000 Aeroplan points when you make your first purchase. New cardmembers only.

-

Our TakeWhy we like it

Most cards make you choose between low fees or valuable travel rewards, but the CIBC Aeroplan Visa offers both.

Pros- An attractive intro offer that could be enough for a one-way economy class flight in North America.

- Your Aeroplan membership will help you earn points twice as fast at Aeroplan partners and retailers in the Aeroplan eStore when you pay with your Aeroplan credit card.

Cons- To get the best value, you’ll have to be loyal to Air Canada and the Aeroplan rewards program.

- Earn rate on included categories is lower than some other no-fee cards.

-

Product Details

- 1x Aeroplan points per dollar on gas, groceries and Air Canada travel purchases, up to $40,000 annual spend.

- 1x Aeroplan points per $1.50 spent on all other purchases, including gas, groceries and Air Canada travel purchases that exceed the $40,000 threshold.

- Earn points twice at over 150 Aeroplan partners and 170+ online retailers through the Aeroplan eStore.

- Aeroplan Points never expire and can be redeemed for a variety of travel, merchandise, gift card, and other rewards offered by Aeroplan’s participating partners and suppliers.

- $0 annual fee.

- Primary Aeroplan credit cardholders may get access to preferred pricing, which means you can book flight rewards for even fewer points.

- Get three free months of Uber Pass for discounts on rides, meals and more.

- Earn 1 Aeroplan point for every $6 spent on CIBC Global Money Transfer, with no transaction fees or interest as long as you pay your balance on time.

- Use the CIBC Pace It feature to make installment payments on large purchases.

- Four types of insurance are provided: car rental collision and loss damage insurance, purchase security and extended protection insurance, and common carrier travel accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To be eligible, $15,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

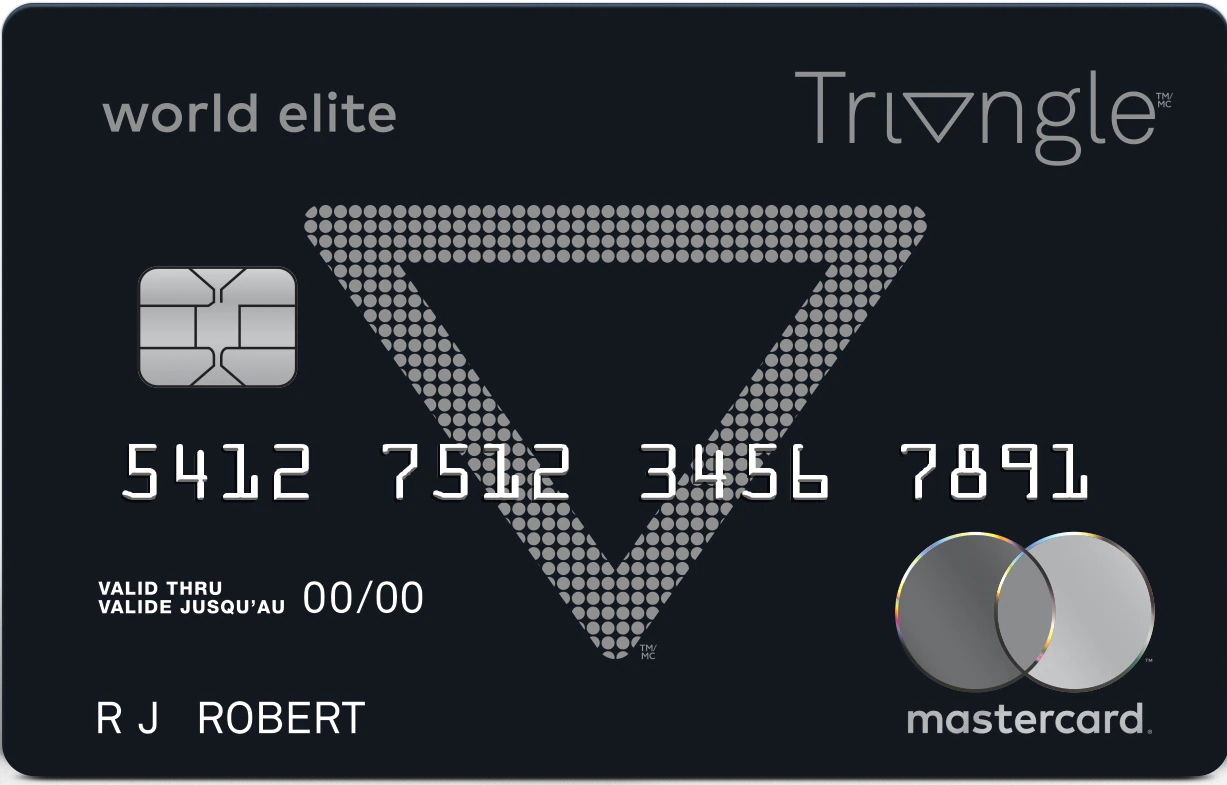

Best no-fee card for in-store shopping

Triangle™ World Elite Mastercard®

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% on purchases, 22.99% on cash transactions (21.99% in Quebec).

-

Rewards Rate1%-4%4% at Canadian Tire or its affiliated stores, 3% at grocery stores (on the first $12,000 per year), and 1% on grocery stores after that. Plus, collect 5¢-7¢1 per litre at Gas+/Essence+ locations.

-

Intro OfferN/A

-

Our TakeWhy we like it

The Triangle™ World Elite Mastercard® is the ideal choice for shoppers hoping to collect and redeem as much Canadian Tire Money as possible. The roadside assistance package cardholders get access to is a nice perk, too.

Pros- Solid Canadian Tire Money earn rates on groceries, sports equipment and other merchandise at participating stores.

- No annual fee.

- Access to various insurance plans.

Cons- Not much added value if you don’t shop at Canadian Tire or its affiliated stores.

- Large families could burn through their accelerated earn rates on groceries sooner than they’d like.

- Earning Canadian Tire Money on gas purchases could be challenging if you don’t live near an eligible gas station.

-

Product Details

- Collect 3% in Canadian Tire Money on the first $12,000 spent at eligible grocery stores per year and 1% on eligible grocery purchases after that.

- Collect 4% in Canadian Tire Money on qualifying purchases at Canadian Tire, Sport Chek, Mark’s/L’Equipeur, Atmosphere, Party City, Sports Rousseau, Hockey Experts, L’Entrepot du Hockey and participating Sports Experts stores.

- Collect 7 cents in Canadian Tire money per litre of premium fuel, and 5 cents per litre on all other fuel types purchased at Gas+/Essence+ locations.

- Canadian Tire Money can be redeemed at Canadian Tire, Sport Chek, Atmosphere, Sports Rousseau, Hockey Experts, L’Entrepot du Hockey and participating Mark’s/L’Equipeur and Sports Experts stores.

- No fee, no interest financing on qualifying purchases of $150 or more at participating stores. Conditions apply.

- No-receipt returns at participating stores.

- Access to member-only events and personalized offers.

- Priority queuing when calling the Triangle call centre.

- Enrollment in the Triangle World Elite Mastercard Roadside Assistance Gold Plan, which includes 5 service calls per year and unlimited tows to any Canadian Tire Auto Service Centre within towing limits.

- Car rental collision/loss damage waiver insurance.

- Extended warranty insurance for eligible purchases.

- Eligibility: Must be a Canadian resident and the age of majority in the province/territory of residence.

- No annual fee.

- No fee for obtaining a supplementary card on the same account.

- Interest rates: 19.99% on purchases, 22.99% on cash transactions (21.99% in Quebec).

Best no-fee card for online shopping

Amazon.ca Rewards Mastercard®

-

Annual Fee$0

-

Interest Rates19.99% / 22.99%19.99% for purchases, 22.99% for cash advances.

-

Rewards Rate1%-5%5% intro offer. 2.5% on Amazon.ca and Whole Foods Market store purchases for Prime members (1.5% for non-Prime members). 1% on eligible foreign currency transactions and everywhere else Mastercard is accepted.

-

Intro OfferUp to $150Get 5% back at Amazon.ca, Whole Foods Market stores in Canada, grocery stores and restaurants! Valid for the first 6 months, on your first $3,000 in eligible purchases.

-

Our TakeWhy we like it

Ideal for Amazon shoppers with 2.5% back on all eligible Amazon.ca and Whole Foods purchases. Plus, Amazon Prime members get 2.5% back on eligible foreign currency transactions.

Pros- No annual fee.

- Apply rewards to eligible Amazon.ca purchases.

Cons- Amazon Prime membership required for higher earn rate.

-

Product Details

- Welcome offer: Get 5% back at Amazon.ca, Whole Foods Market stores, grocery stores, and restaurants for 6 months after approval, on first $3,000 in eligible purchases.

- Earn rewards on eligible purchases at Amazon.ca — including Whole Foods Market stores in Canada.

- After the welcome offer ends, eligible Prime members get 2.5% back on eligible purchases at Amazon.ca and Whole Foods Market stores.

- Eligible Prime members always get 2.5% back on eligible foreign currency transactions to help cover foreign transaction fees.

- After the welcome offer ends, non-Prime members get 1.5% back on eligible purchases at Amazon.ca and Whole Foods Market stores. Always get 1% back on eligible foreign currency transactions to help cover foreign transaction fees.

- Receive 1% back on eligible purchases everywhere else Mastercard is accepted.

- Rewards can be redeemed at Amazon.ca and applied directly to eligible Amazon.ca items.

- No annual credit card fee.

- The MBNA Payment Plan can make it more convenient to pay for large purchases and manage a budget. Pay for eligible credit card purchases of $100 or over by making monthly payments. Choose from three Payment Plan terms: 6, 12 or 18 months. Conditions and fees apply.

- Preferred rates: 19.99% for purchases, 22.99% for cash advances.

- To be eligible, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

Methodology to identify the best no-fee credit cards

- Rewards value considers earning rates, rewards structure, promotional rates and spending categories.

- The intro offer considers the welcome bonus value, promotional interest rates, and any waived fees.

- Fees and interest consider interest rates for purchases, balance transfers and cash advances, and additional costs such as foreign transaction fees.

Summary of our selections for the best no-fee credit cards

Summary list

- Neo Card™ (Secured)

- American Express® Green Card

- MBNA Rewards Platinum Plus® Mastercard®

- BMO AIR MILES®† Mastercard®*

- KOHO Standard Prepaid Mastercard

- Scotia Momentum® No-Fee Visa* card

- Tangerine Money-Back Credit Card

- Scotiabank Red American Express® Card

- MBNA True Line® Mastercard® credit card

- TD Business Cash Back Visa* Card

- Simplii Financial™ Cash Back Visa Card

- BMO® AIR MILES®† No-Fee Business® Mastercard®*

- CIBC Aeroplan® Visa Card

- Triangle™ World Elite Mastercard®

- Amazon.ca Rewards Mastercard®

How no-fee credit cards work in Canada

By Barry Choi and Shannon Terrell

What is a no-fee credit card?

A no-fee credit card doesn’t have an annual fee: the lump sum amount charged by card issuers to help cover the cost of card rewards and programs. Most of the best Canadian credit cards carry annual fees over $100.

Now, this isn’t to say you won’t ever pay any fees while holding a no-free credit card — you’ll likely still need to deal with interest charges, inactivity fees and the like. But annual fees? No-fee cards don’t have any, which could help you trim down on unnecessary costs.

The only downside? No-fee cards may not offer the same premium perks that often accompany cards with steep annual fees. That said, no-fee cards still have some perks, including cash-back reward programs, travel points and more.

Is a no-fee credit card a free credit card?

A no-fee card isn’t exactly the same as a free credit card. While no-fee credit cards don’t charge you an annual fee, there will likely be other costs associated with using a no-fee card, including:

- Interest charges.

- Cash advance fees.

- Foreign transaction fees.

- Over limit fees.

- Inactivity fees.

- Balance protection insurance.

All of these additional fees should be clearly outlined in the terms and conditions that come with your card. Depending on howAs long as you use your no-fee credit card responsibly, it may be possible to avoid fees completely.

Common features of a no-fee credit card

Every no-fee credit card is unique, so the included features will differ. That said, here are some of the common features you may get:

- Interest-free grace period.

- Fraud protection.

- Increased earn rate on some merchant categories.

- Rewards (cash back, travel, store, etc).

- Purchase protection.

- Extended warranty.

Admittedly, no-fee credit cards often have fewer benefits compared to credit cards that come with an annual fee. But some no-fee credit cards may still include helpful perks, such as mobile device protection or travel insurance.

Do no-fee credit cards still earn rewards?

Yes, there are many no-fee credit cards that earn rewards. The type of rewards you’ll receive depends on what card you choose. The typical rewards categories are as follows:

- Cash back: You’ll get a percentage back in cash on all of your purchases with these no-fee cards.

- Travel: You can earn airline, hotel or even general travel rewards points with these no-fee cards.

- Store or retail: The rewards you earn with store or retail credit cards can be redeemed at participating stores for groceries, merchandise and more with these no-fee cards.

When is an annual fee worth paying?

Annual fees for Canadian credit cards can range from $6.95 to $699, and the cost may be worthwhile — it really all depends on your financial situation, lifestyle and spending habits.

For example: a travel credit card with an annual fee may be a practical fit if you’re often on the road and frequently purchase travel insurance — a perk offered by numerous travel rewards cards.

Or maybe it’s a cash-back credit card with an annual fee that offers bonus rewards for something you spend a lot of money on, like gas or groceries.

Essentially, a credit card’s annual fee is worth it if the amount of value (savings or rewards) you can squeeze from the card each year is higher than the amount of the fee.

Types of no-fee credit cards in Canada

There are many types of no-fee credit cards available, with the best offering the ability to earn valuable rewards, cash back and more, all without having to pay an annual fee.

No-fee cash back credit cards

Cash-back credit cards are fairly simple as far as perks are concerned: spend money; get a percentage of what you’ve spent back in cash. Now, as for the type of purchases that earn rewards and how much cash back you get for them, that’s what separates different types of cash-back cards.

Take the Simplii Financial Cash Back Visa Card: it’s a no-fee cash back card that offers 4% cash back each time you swipe your card at a restaurant, bar or coffee shop, up to $5,000 per year.

In comparison, the BMO CashBack Mastercard offers 3% in cash back on grocery purchases, up to $500 in spending per billing cycle.

No-fee travel credit cards

Travel cards offer travel-related rewards when you use your card. Some travel cards charge large annual fees in exchange for premium perks, like comprehensive travel insurance packages.

But the rewards offered by no-fee travel credit cards are nothing to sneeze at. The CIBC Aeroplan Visa doesn’t carry an annual fee and earns Aeroplan points every time you spend on gas, groceries and Air Canada travel purchases, for example.

And the Rogers World Elite Mastercard, another no-fee card, comes with travel insurance offerings and access to over 1,000 LoungeKey airport lounges.

No-fee rewards cards

Rewards cards allow you to earn points for making eligible purchases. And these points can be redeemed for all types of perks, from travel vouchers to electronic gift cards.

For example, the American Express Green Card lets you earn rewards points across a variety of spending categories and points can be put towards purchases, travel spending, gift cards; you name it. Plus, you can transfer points to other loyalty programs, like Aeroplan and Marriott Bonvoy.

No-fee Mastercards

Credit cards branded with the Mastercard name or logo belong to the Mastercard network. Mastercard is not a card issuer, it simply processes credit card payments. And because Mastercard is one of the most popular card processors in the world, there are plenty of cards to pick from — including cards without annual fees.

One example of a no-fee Mastercard with generous perks is the Brim Mastercard. It earns rewards points on everyday purchases, offers free global WiFi access and comes with travel, event ticket and mobile device insurance coverage.

Who should get a no-fee credit card?

A no-fee card may not be suitable for everyone, depending on their spending habits and financial goals, but there are some circumstances in which this type of card is a practical fit:

- You’re building your credit history. When you begin building your credit history, a card with a high annual fee may not be helpful. No-fee cards are free to carry, so they can help you focus on building your credit without having to worry about whether you’re using your card often enough to justify the annual cost.

- You don’t use your card that often. Getting a card with an annual fee makes sense if you’re able to earn more than you pay — but this tends to require more frequent use and thousands of dollars in spending. If you only anticipate using your credit card for the odd infrequent purchase, a no-fee card may be more practical.

- You’re seeking a secondary card. Maybe you’ve already got a credit card, but you want a secondary card to double down on the points-earning process. A no-fee card might be the way to go. Or, maybe you’d like a Visa to compliment your Mastercard — or vice versa. Not all merchants accept both.

Advantages of no-fee credit cards

- No annual fee. As long as you’re paying your balance in full and on time each month, it doesn’t cost you anything to have the card.

- You can keep your account open for a long time. Since it doesn’t cost anything to keep the card active, your total available credit will grow, which has a positive effect on your credit utilization — one of the biggest factors in your credit score.

- Good for emergencies. No-fee credit cards are low-cost and low-maintenance, so they make for an excellent backup credit card.

- Helps you build credit. Using your credit card responsibly will build your credit history and credit score.

- Earn rewards. You can earn points or miles that can later be redeemed for travel or merchandise.

Disadvantages of no-fee credit cards

- Limited benefits. Credit cards that charge an annual fee often have better benefits and higher reward earn rates.

- Smaller welcome bonus. No-fee cards usually have a less generous sign-up offer compared to cards with a fee.

- Can create high-interest debt. As with all credit cards, you could go into debt if you don’t manage your spending.

How to choose a no-fee credit card

When comparing credit cards it’s typically important to assess the annual fee they charge. Of course, with no-fee cards, this isn’t a concern. But that doesn’t necessarily mean they’re all the same. Here are some other things to consider when deciding between no-fee credit cards in Canada.

Interest rate

All credit cards — even no-fee cards — charge interest and those interest rates should factor into the card you choose. The no-fee cards on our list carry an average purchase interest rate of 20.2%, which is pretty standard. The average interest rate for a Canadian credit card in any category is 19.4%, but cards with lower rates exist, some under 10%. They’re rare, but they’re out there.

If you tend to carry a balance on your card, keep your eyes peeled for no-fee cards with lower interest rates — anything under 20% is a competitive rate in this category.

Welcome bonus or intro offer

Introductory offers often come in the form of special cash-back offers or extra rewards points. They’re designed to help incentivize new card applications and could be a factor worth considering as you narrow down your no-fee credit card options.

The caveat to welcome bonuses? You don’t always get the points or cash just for signing up. To nab the intro offer, you may have to spend a minimum amount within a certain time frame after opening the card, for example. The thing to note about welcome bonuses or intro offers is that they’re typically temporary, often ending after a few months.

Ongoing rewards rate

When comparing no-fee card options, take a look at what type of rewards the card will earn even after the intro offer expires — more specifically, how they’re earned and ways they can be redeemed.

Whether you earn points from affiliated travel programs or cold hard cash back on eligible purchases, you’ll want a rewards program that will encourage you to make the most of your spending.

Perhaps even more important, however, is how points are earned. One card may offer triple the points on your weekly grocery bill, while another may let you double down on your travel miles each time you book a flight with a qualifying carrier.

Credit card insurance

Some no-fee credit cards come with insurance coverage, but not all. Insurance coverage offerings may include travel insurance, event ticket protection, extended warranty and purchase security protection and more.

Insurance coverage through your no-fee credit card may not be a strict necessity if you have coverage through an independent insurer or through your employer. But it can offer added protection and peace of mind, depending on the coverage available.

How to apply for a no-fee credit card

To apply for a no-fee credit card in Canada, you’ll first need to ensure that you meet the issuer’s eligibility requirements, and then follow the typical steps to submit an application.

Eligibility requirements for a no-fee credit card

Eligibility criteria may vary, but the baseline requirements for a no-fee credit card tend to be fairly standard.

Age and residency status

You must be a Canadian resident, and you must be the age of majority in the province or territory you live in.

Credit score

All of the no-fee cards on our list require applicants to have a Canadian credit file, so if this is your first credit card, you may need to explore other options, like getting a secured credit card, instead.

Minimum credit score thresholds may also come into play, depending on the card you choose.

Personal or household income requirements

Income requirements tend to be more common among high-tier credit cards, like the HSBC World Elite Mastercard which requires a personal income of $80,000 or a household income of $150,000.

No-fee credit card income requirements tend to be much lower (if they’re required at all), like the Simplii Financial Cash Back Visa Card that requires a personal income of $15,000.

Steps to apply for a no-fee credit card

When you apply for a no-fee credit card, there’s no guarantee you’ll be approved. The credit card provider needs to assess your financial profile to determine if you’re creditworthy. The application process will typically look something like this:

- Fill out an application. This can be done online or at your financial institution. The application will ask for some basic information, such as your name, date of birth, address, social insurance number, employer and income.

- Your information is checked. The credit card issuer will make an inquiry on your credit report and verify the information that you provided.

- A decision is made. If you apply online, instant approval (or disapproval) is possible, but there’s also a chance the credit card issuer will ask you to contact them to provide additional information.

- Your card is mailed out. Your credit card will immediately be mailed out and will typically arrive within 14 business days.

- Activate your card. Once your card arrives, you’ll need to activate it by logging into your account or calling the number on your card. Once activated, you can use your card to make purchases.

Can you get a no annual fee credit card with bad credit?

It depends on your situation.

For example, if you’re a student, some financial institutions will approve you for a no-fee student credit card even if you don’t have much credit history.

On the other hand, if you have a bad credit score due to previous financial difficulties, you may not be approved for a traditional no-fee credit card. However, you may still get another type of credit card.

You would likely still qualify for a no-fee secured credit card. These types of credit cards are similar to regular credit cards, but you need to deposit security funds. These funds act as your credit limit, but you can’t use them to pay your card balance.

-

FAQs for Canada's no-fee credit cards

-

Who should get a no-fee credit card?

A no-fee credit card is suitable for many people. Those who don’t plan to spend much on their card, those who just want a backup credit card that earns decent rewards, and those who just don’t want to pay an additional fee will find no-fee cards attractive.

-

How are no-fee credit cards different from debit cards?

No-fee credit cards are similar to other unsecured credit cards and operate like a short-term loan. You borrow money from your credit card issuer and those funds must eventually be paid back. With your debit card, you can only spend money from your bank account. Since you aren’t borrowing money with a debit card, you won’t be charged interest.

-