Bonus Tax Rate: How Are Bonuses Taxed, Who Pays?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Bonuses are considered supplemental wages.

Employers can use one of two methods to withhold taxes on a bonus: percentage or aggregate.

Bonuses are generally taxed at a flat rate of 22% when the percentage withholding method is applied.

Tax withholding on a bonus can have an effect on overall tax liability.

Earning a bonus can feel like a well-deserved reward. After all, who doesn't want a pat on the back plus some extra cash to put toward a feel-good purchase? But you might be in for a surprise when your paycheck arrives, and you realize, “Wait a minute — this gets taxed, too?”

Bonuses are indeed taxed. And how they get sliced and diced depends on a few things, including your employer's calculation method.

Here’s a guide to how bonuses are taxed, the two methods employers can use to calculate your withholding, and some tips for minimizing the tax impact of a bonus.

What is a bonus?

A bonus is a form of compensation awarded to a worker at a company's discretion. Bonuses are usually lump sums that are paid out in addition to a worker's existing salary or wages.

Most often, bonuses are distributed on special occasions (e.g., a holiday) or built into certain compensation plans (e.g., for hitting a quarterly sales goal). Other types include annual, merit, referral, sign-on and retention bonuses.

How are bonuses taxed?

The IRS views any bonus you receive as income.

In the short term, that means a chunk of that bonus will be withheld from your check by your employer for taxes. You might also need to pay state taxes and Medicare and Social Security taxes (also called FICA taxes) on the bonus.

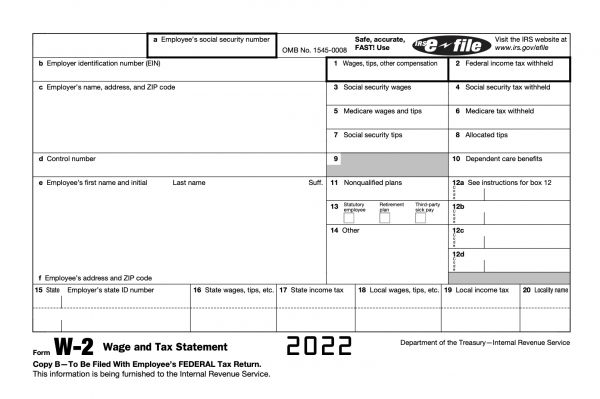

In the long term, the bonus will be added to your total income for the year. The total amount you received in bonuses for the year will be combined with other earned income and listed in Box 1 of your W-2.

When it comes time to file your annual taxes, your total income, including your bonus, gets taxed according to your effective tax rate. Employers withhold taxes on your paycheck throughout the year to prepay that tax on your behalf. If you've had enough withheld, you won't owe anything. If you've withheld too much or too little, that might mean a tax bill or a refund.

Tax withholding on bonuses

Unlike your regular income, the IRS lumps bonuses (and other things such as severance pay and commission) into a category called "supplemental wages." And this is often where confusion sets in.

Your employer can use two different methods to calculate withholding on the bonus. In other words, your employer gets to choose how it wants to do the math on your paycheck. The way those numbers get crunched can impact two things: how much of the bonus you'll actually see on your paycheck and your overall tax liability for the year.

The two methods the IRS allows for calculating withholding for bonuses and other forms of supplemental income are the percentage method and the aggregate method.

1. The percentage method

If you receive a bonus separately from your regular paycheck, your employer is likely using the percentage method to calculate how much tax to withhold on your bonus.

Your total bonuses for the year get taxed at a 22% flat rate if they're under $1 million.

If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets taxed at 37%. Your employer must use the percentage method if the bonus is over $1 million.

Benefit: The benefit of this percentage method is that it's relatively easy for the employer, so you'll often see taxes withheld this way on bonuses.

Drawback: The disadvantage of this method is that most people's effective tax rate is not 22%. If you're in a higher tax bracket, there's a chance that not enough of your bonus was withheld for taxes, which can lead to a surprise tax bill at the end of the year. On the other hand, if you're in a lower federal tax bracket, your bonus might get taxed at a higher rate than your regular income. That means more of your bonus will be withheld, but you might get a tax refund when you file.

2. The aggregate method

The aggregate method is the second way employers can calculate taxes withheld on a bonus. This often occurs when your employer lumps your bonus and regular wages into one paycheck.

Your bonus and your regular income/wages are combined into one paycheck.

Your payroll department will withhold taxes on the entire aggregated payment at the same rate. That withholding rate depends on your filing status and the information you provided on your W4.

Benefit: While it's not perfect, the aggregate method has a better chance of ensuring that you're withholding enough to cover your tax liability. Translation: There’s a smaller chance of a surprise tax bill because of your bonus.

Drawback: It requires more work for the employer to calculate — and it's still possible to withhold too much, which could mean a bigger bite out of your paycheck than necessary. But, on the bright side, it gives you a better chance of having an accurate withholding for the year, or possibly a refund.

Aggregate vs. percentage method

The bottom line is that neither the aggregate nor the percentage method is an exact science. Regardless of the calculation method, keep an eye on your total withholdings for the year if you get a bonus. If you have a sense for what your total income will be, you can tinker with your W-4 and adjust your withholding to get out ahead of things before tax time.

How to minimize the tax impact of a bonus

1. Review your W-4

Because bonuses can occur at any point during the year, they get added to your salary piecemeal. And that can inflate your earnings or even push a portion of your income into a new tax bracket, increasing your tax liability.

Before or after your bonus is paid out, it could be worth doing a little maintenance on your W-4 form to adjust your withholdings. Figuring how much to withhold can be tricky, but our W-4 calculator can help you understand whether you're on the track to owe, get a refund, or zero-out your tax liability. A little fiddling can go a long way toward keeping a tax bill at bay.

2. Make sure your bonus is actually taxable

Make sure that the bonus you're getting is actually ... a bonus. The IRS has rules about what it considers taxable. Things like occasional tickets for events, holiday gifts, money for meals while working overtime, flowers, books, and other intermittent low-value fringe benefits are generally considered nontaxable. But once your employer forks over cash, offers you a gift card or hands over a high-value gift, things get murkier. Check with a tax professional if you're ever unsure about the tax implications of a gift or award.

3. Tax deductions

Tax deductions are one of the best-known ways to lower your taxable income and help you offset some of your tax liability. Most taxpayers take the standard deduction, but if your individual tax-deductible expenses — such as unreimbursed medical costs, donations or mortgage interest — add up to more than the standard deduction, itemizing can help you to trim your taxable income and save on your tax bill.

4. Contribute to a tax-advantaged account

As far as tax-mitigation strategies go, this one might be a win-win for most folks.

If you haven’t hit your yearly contribution limit on a tax-advantaged plan, such as your 401(k), HSA or a traditional IRA, consider using your bonus toward a qualifying contribution. Because the money you put into these accounts is pre-tax, it can lower your taxable income while also putting your hard-earned paycheck toward a long-term savings goal.

5. Defer your bonus

Some people might also ask their employer to defer the bonus until the following year. Importantly, doing so does not eliminate the taxes owed — it merely defers the payment of taxes until a later date. This strategy could make sense if:

You think your bonus will push a portion of your income into a higher tax bracket, and you need extra time to save up for the taxes you might owe.

You think your total income next year will be lower than the current year, which might lower your tax liability.

Because this can be a tricky strategy to navigate, make sure to consult a tax professional to ensure it's the right call for your financial picture.