Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Yes, you can contribute to a Roth IRA and a 401(k) at the same time.

Can you have a Roth IRA and a 401(k)?

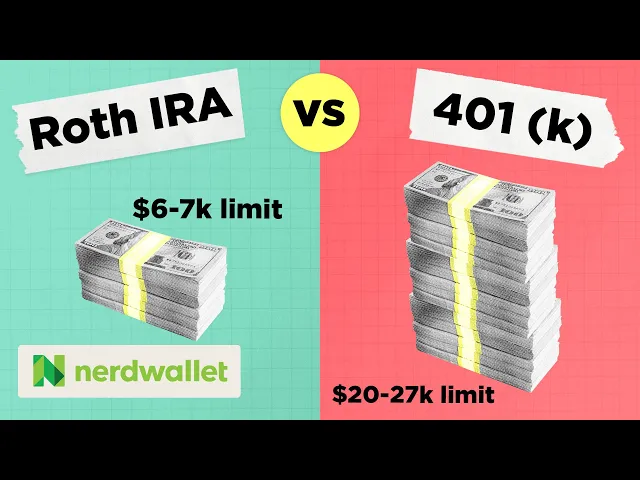

You can contribute up to $22,500 in 2023 to a 401(k) plan. If you’re 50 or older, the annual contribution maximum jumps to $30,000.

You can also contribute up to $6,500 to a Roth IRA in 2023. That jumps to $7,500 if you’re 50 or older. However, there are income limits, which you can learn more about on our Roth IRA income limits page.

If you can max out both plans, congratulations: You’re well on your way to retirement success.

» Check out our top picks for the best Roth IRA accounts

Fees $0 per trade | Fees 0% management fee | Fees $0 no account fees to open a Fidelity retail IRA |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion Up to $600 when you invest in a new Merrill Edge® Self-Directed account. | Promotion Free career counseling plus loan discounts with qualifying deposit | Promotion Get $100 when you open a new Fidelity retail IRA with $50. A 200% match. Use code FIDELITY100. Limited time offer. Terms apply. |

AD Paid non-client promotion |

How to choose between a Roth IRA and a 401(k)

If you can’t contribute the maximum to both types of accounts, don’t fret. Most of us fall into that group. The ideal amount to save for retirement will vary by your financial situation and your overall goals. Check out our retirement calculator to measure your progress.

If you’re trying to figure out which type of account is the best place for your hard-earned dollars, start here:

If your employer offers a matching contribution in your 401(k) plan, get as much of that free money as you can.

Once you’re getting the full match, consider the pros and cons of a Roth IRA versus a 401(k). A lot will depend on the 401(k) you have. Some plans offer a good selection of low-cost investments; others, not so much. Some employers cover the plan’s administrative costs; others pass on those costs to employees. The beauty of an IRA (whether Roth or traditional) is that you can open one at just about any discount broker, with no account fees and access to a wide variety of low-cost investments.

Still not sure which account is best for you?

Dive into our road map for how to choose between an IRA and a 401(k)

And check out our tips for how to choose between a Roth 401(k) and a Roth IRA

» Find out how to invest your IRA