What Is a FICO Score? FICO Score vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

What is a FICO score?

FICO scores are one kind of credit score.

The name derives from the Fair Isaac Corp., which introduced the FICO score in 1989. The terms “credit score” and “FICO score” are often used interchangeably, but there are other brands of scores.

What is the FICO score range?

Most FICO scores are on a range of 300 to 850, and a higher score indicates better credit.

FICO also offers industry-specific scores for credit cards and car loans, which range from 250 to 900.

How is a FICO score calculated?

The company applies a proprietary formula to the data in your credit reports to produce a score.

Often, the three credit bureaus that create your credit reports — Equifax, Experian and TransUnion — have slightly different data from one another. So your score may vary depending on which bureau's data was used.

What is a good FICO score?

Generally, scores from 690 to 719 are considered good credit. But each lender or credit card issuer can decide what score is needed to qualify for a particular line or credit.

The FICO company itself defines a good score as 670-739.

Why is a FICO score important? What is a FICO score used for?

Creditors often use FICO scores in making decisions about whether to approve an application for a loan or a credit card. It gives them a picture of how you've handled credit in the past. They also check other information, such as your income and existing debt obligations, to see whether you have the means to repay them.

A score that is in the good or excellent range can give you more choices and access to lower interest rates.

Your credit score may also be used by utility companies and/or landlords to determine your deposit or whether you'll be accepted as a tenant.

What affects your FICO score?

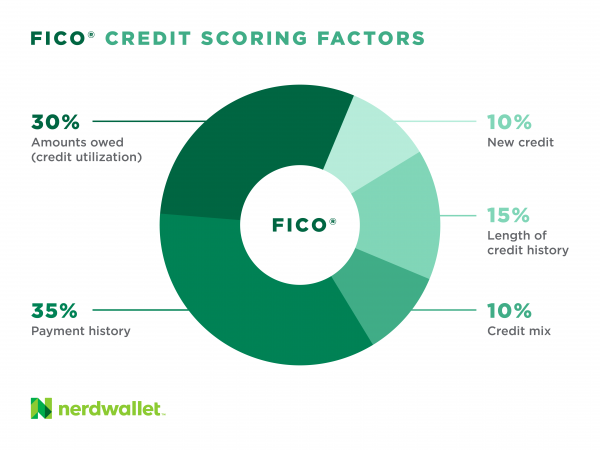

While FICO doesn’t reveal its scoring formula, it gives useful guidelines about the factors that matter for scores. As you can see, paying on time and keeping balances low account for about two-thirds of your score:

Payment history (35% of your score): Late payments can really hurt your score, as can accounts in collections or a bankruptcy.

Amount of debt relative to credit limits (30%): This is how much of your available credit you are using — the less, the better for your score.

Age of credit (15%): This refers to how long you’ve had credit and the average age of your credit accounts.

Recent applications for credit (10%): A so-called “hard inquiry” when you apply for new credit can nick your score for up to six months. That's why it's important to research credit card offerings and eligibility requirements before applying to one.

Whether you have more than one type of credit (10%): Having both installment loans (those with level payments, like a car loan or mortgage) and revolving credit (like a credit card) can help your score.

Take control of your finances - track and improve your credit score with our weekly Nerdy insights. Sign up free

FICO score vs. credit score

FICO scores are one type of credit score (VantageScore being another), but you can also have multiple versions of a FICO score. FICO 8, introduced in 2009, is the most widely used, while FICO 9 as well as FICO 10 and FICO 10T are newer versions. Although mortgage lenders typically use much older FICO score versions, they will begin using FICO 10 and 10T in the next few years.

UltraFICO, another newer type, is meant for people new to credit or looking to rebuild credit. It is on the same 300 to 850 scale as FICO but it uses activity in deposit accounts to calculate a score.

FICO vs. VantageScore

VantageScore was developed jointly by the three major credit bureaus and introduced in 2006. FICO is well known by consumers and widely used by lenders; however, VantageScore is gaining traction with both consumers and lenders. A study by VantageScore found that 12.3 billion of its credit scores were used by more than 2,500 lenders from July 2018 to June 2019.

FICO says it is used in at least 90% of lending decisions, and it's favored by the law in one crucial spot: home mortgages. Right now, it’s the only tool to evaluate credit risk that is approved for use by government-sponsored enterprises such as Fannie Mae and Freddie Mac.

However, in October 2022, the Federal Housing Finance Agency required the use of FICO 10T and VantageScore 4.0 for loans sold to Fannie and Freddie. Although implementation of these two scoring models will take "a multiyear effort" to coordinate, the benefits are expected to be significant, especially for minority home buyers.

How do I get a FICO score?

You may already have access to a free FICO score on your credit card statement. Some credit card issuers such as Bank of America give customers free FICO scores monthly, while Discover has gone further and made FICO scores free for anyone.

You can also pay to get a FICO score via the company’s own website, particularly if you want a version other than the free ones supplied by a credit card.

Many personal finance websites, including NerdWallet, offer a free credit score from VantageScore, FICO's main competitor. That gives you another option for watching your score: VantageScores tend to track similarly to FICO scores, because both weigh much the same factors and use the same data from the credit bureaus.