How to Get Your Free Credit Reports From the Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until the end of 2023, those reports — which had been limited to once a year — are available weekly to help consumers manage their finances.

Take control of your finances - track and improve your credit score with our weekly Nerdy insights. Sign up free

Your credit reports are a detailed record of your past use of credit — but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Here’s how to use AnnualCreditReport.com.

1. Go to the correct site

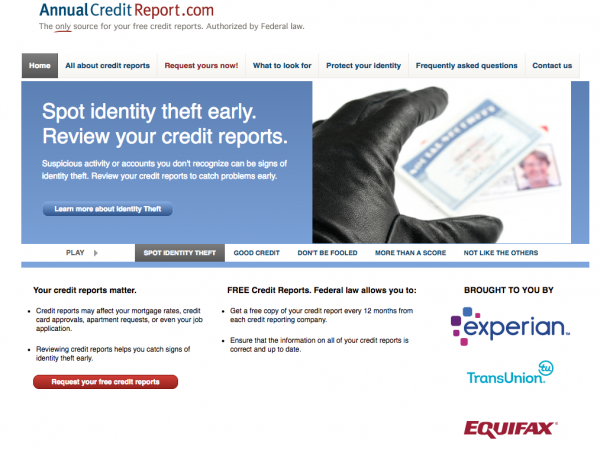

First, make sure you’re on the right site: AnnualCreditReport.com. Some other sites have similar-sounding names.

The one you want looks like this:

2. Enter your personal information

You'll need your name, Social Security number, address and birthdate. This, along with other personal data, will be matched against files for identification.

3. Request a credit report or reports

You can order your reports from one, two or all three of the major credit bureaus: Equifax, Experian and TransUnion.

4. Successfully answer security questions

For each report request, you’ll be asked a few questions about your finances that presumably only you can answer — for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you can’t recall those details, you can request your reports by mail or phone; this process doesn’t require security questions.

5. Generate your credit report online

You can save reports to your desktop or print them out so you’ll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

6. Read your reports and fix errors

Read your credit reports, looking for:

Accounts that aren’t yours or you didn’t authorize.

Incorrect, negative information.

Negative information that’s too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those aren’t factored into your score.

If you find errors, dispute them. Typically, the fastest way to file a dispute is online, but you can also call the credit bureaus or send a credit dispute letter by mail. The credit bureaus will investigate and must remove information that they can’t verify.

7. Monitor your credit regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Here’s how the information you’ll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

Reports (not scores)

Data from all three major credit bureaus

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

Credit scores, sometimes credit report information

Unlimited access

Data from one or two credit bureaus

A recent history of your credit use

Additional information about building and protecting your credit