NerdWallet 2021 Tax Report

Tax Bills Drive Millions of Late 2019 Returns and 2021 Stress

By Elizabeth Renter

February 2, 2021

Few look forward to preparing their income tax returns each year, and unless you have a refund coming, a turbulent economy makes tax time even more nerve-wracking.

American taxpayers were in the middle of tax-filing season last year when the magnitude of the coronavirus pandemic was starting to take shape. “Social distancing” was still a new phrase when the IRS announced it would extend the normal filing deadline to July 15, and millions took the IRS up on this offer to take more time with their tax returns. However, millions more missed that deadline, too, and largely because they were unable or unwilling to pay their tax bill, according to a new NerdWallet survey conducted online by The Harris Poll in mid-December.

The survey of over 2,000 U.S. adults found that many (59%) of those who failed to file on time last year did so because they knew they owed a federal tax bill or were afraid they’d owe after preparing their return. And turning to their 2020 federal returns — the ones due this coming April — many Americans are feeling similarly: One-third (33%) of those planning to file are feeling stressed or anxious about owing money.

“Filing your taxes, especially if you think you might owe money, can be extremely stressful, even in a normal year,” says Kimberly Palmer, personal finance expert at NerdWallet. “Now, with so many people also experiencing income changes and uncertainty, it can feel even scarier. But filing by the deadline can also be a big relief, saving you from big penalties if you have a tax bill, but especially if you discover you’re getting a refund or owe less than you feared.”

Note: Throughout the report, “filers” refers to Americans in our survey who said they plan on filing or did file a federal tax return for the tax year specified.

Table of contents

Key Findings

Millions of taxpayers filed late in 2020, facing possible penalties and interest. Though more than half (56%) of Americans filed their 2019 federal income tax return on or before the original April 15 due date, 11% filed after the July 15 extension, and some (3%) still have yet to file.

Tax bills are the primary motivator for later filers. Of Americans who failed to file their 2019 federal tax return by July 15, 2020, 27% say they filed after because they knew they owed additional taxes and were able to pay but didn’t want to, and 24% knew they owed but were unable to pay.

Half of 2020 filers are expecting refunds. Half (50%) of Americans planning to file a 2020 federal tax return anticipate receiving a refund. They expect to receive about $2,000, on average.

Most Americans think the tax-filing system is too complicated. More than three-quarters (78%) of Americans believe the American tax-filing system is too complicated and should be simplified. Nevertheless, more than half (56%) of 2020 filers will prepare their federal return themselves.

Many filed 2019 returns late despite extended deadline

On March 21, 2020, the IRS announced it would extend the traditional filing deadline for 2019 federal income tax returns by three months. Despite this grace period, 56% of Americans say they made the original April 15 deadline. An additional 14% say they filed on or before July 15.

But 11% of Americans filed after the July 15 extended deadline, including nearly 18 million (7%) who filed an extension with the IRS and about 10 million (4%) who didn’t. Those who filed late without submitting an extension risk stiff penalties and interest on any taxes owed. Another 3% of Americans, or 7.7 million, have yet to file.

Tax tip: Aim to file on time, and when you can’t, file an extension so the IRS knows your return is coming. Filing an extension is free and essentially gives the IRS a heads-up that you haven’t forgotten about them. It gives you more time to file, but not more time to pay, so send what you can if you owe. You’ll still be charged interest on any owed federal income taxes, but you won’t be penalized as severely as those who skip the extension.

Tax bills motivated late 2019 returns

Many of those who failed to file by the July 15 deadline were late because they anticipated a tax bill they couldn’t (or didn’t want to) pay, according to the survey.

Of those who failed to file by July 15, 27% knew they owed and were able to pay but didn’t want to, 24% knew they owed but were unable to pay, and 18% didn’t know whether they owed money or not but were afraid to receive a bill they couldn’t pay.

“If you know you owe the IRS but you aren’t sure how much or if you can afford to pay it, then you might be dreading filing,” Palmer says. “But once you prepare your return, and know exactly how much you owe, you can make a payment plan, allowing you to spread your payments out over time.”

One-third (33%) of those who will file a 2020 return say they’re feeling stressed or anxious about owing money or owing more money than they anticipate this year. Having a plan in place should this happen may set their minds at ease.

Tax tip: If you can’t pay your tax bill all at once, don’t panic. You have options. The IRS offers two types of installment plans, depending on how much you owe. Or, consider a credit card with a 0% introductory offer, but only if you know you’ll be able to pay it off before the interest-free period ends.

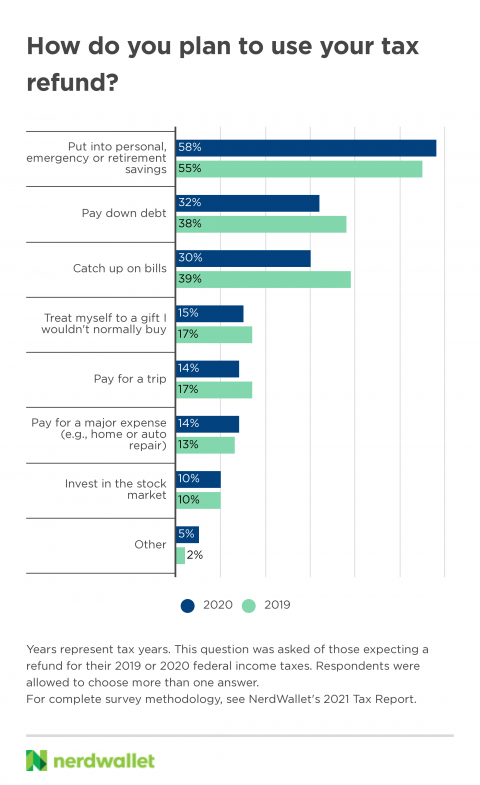

Savings and bills are top 2020 refund uses

Not everyone is fearing a tax bill when they file their 2020 federal return this year. Half of filers (50%) are expecting a refund, 30% expect to break even and 19% expect to owe. Those expecting a refund estimate they’ll receive about $2,000, on average, and largely plan to put that money toward savings, debt and getting caught up on bills.

Tax tip: Your income tax refund is the taxes you’ve overpaid throughout the year. For many people, this overpayment is a kind of savings plan, one that sets aside money from their paychecks before they even see it. But others could benefit from having that money in hand throughout the year. If that’s you, consider adjusting your withholdings on your W-4 now for the 2021 tax year. You’ll get a bigger paycheck and stop giving the government an interest-free loan.

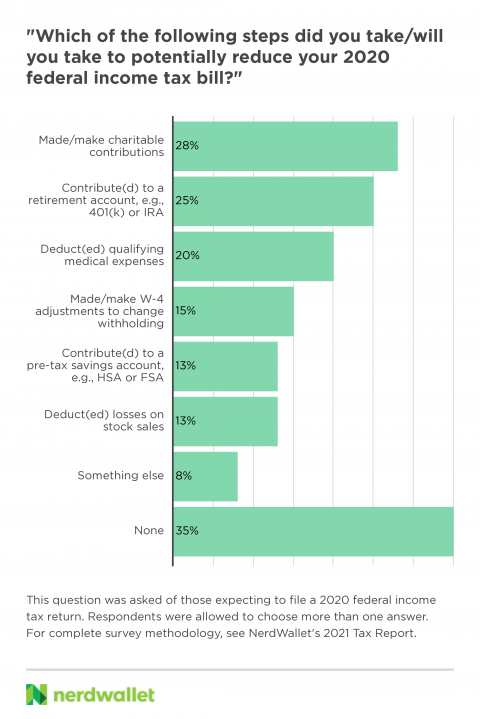

Minimizing tax liability is a major goal

About two-thirds (65%) of filers took or plan to take steps to reduce their 2020 federal income tax bill, according to the survey.

In a year of increased attention to social and racial justice movements, not to mention many Americans suffering from illness and unemployment, there were plenty of reasons to donate to charity. And 28% of filers said they did or would make charitable contributions to reduce their 2020 federal tax bills, according to the survey.

Americans pine for a simpler system

About 3 in 10 (29%) of 2020 filers feel stressed or anxious about making a mistake when they file their federal income taxes. This could be due, in part, to the steps required to file taxes each year. In fact, more than three-quarters (78%) of Americans believe the American tax-filing system is too complicated and should be simplified.

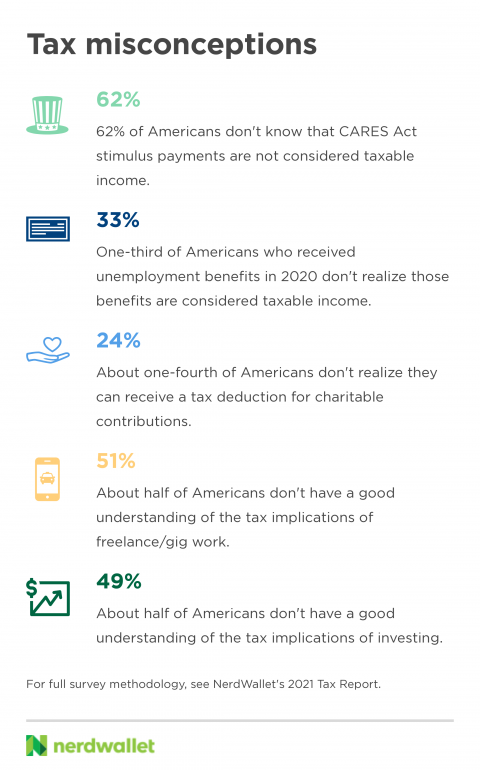

Still, 56% of 2020 filers will prepare their federal return themselves, many (35%) depending on software to guide them through the process. Those braving their own returns may want to brush up on their tax knowledge, however, as the survey revealed many have misconceptions.

Tax tip: Tax software can take the stress and guesswork out of preparing your income tax return each year, but don’t hit submit without checking your work. Having a basic understanding of how your individual situation affects your tax liabilities can save you from making a mistake the software doesn’t catch.

“Getting organized and collecting your paper trail from the year is often the hardest part, but going over the numbers and double-checking your work can be reassuring, too,” Palmer says. “Even if you work with a tax preparation website or professional, it’s a good idea to review all the paperwork yourself so you feel confident that everything is correct.”

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of NerdWallet from Dec. 14-16, 2020, among 2,041 U.S. adults ages 18 and older, among whom 1,553 will file a 2020 federal tax return. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Madison Gouveia at [email protected].

Population calculations based on the U.S. Census population estimates as of July 1, 2019.