Interactive Brokers Review 2023: Pros, Cons and How It Compares

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Our Take

5.0

The bottom line:

on Interactive Brokers' website

Pros & Cons

Pros

Large investment selection.

Strong research and tools.

Over 18,000 no-transaction-fee mutual funds.

NerdWallet users who sign up for IBKR Pro get a 0.25 percentage point discount on margin rates.

Cons

Website is difficult to navigate.

Compare to Similar Brokers

Current Product

NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 |

Fees $0 per trade | Fees $0 per trade for online U.S. stocks and ETFs | Fees $0.005 per share; as low as $0.0005 with volume discounts | Fees $0 per trade | Fees $0 per trade |

Account minimum $0 | Account minimum $0 | Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion None no promotion available at this time | Promotion Get $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. | Promotion Exclusive! US resident opens a new IBKR Pro individual or joint account receives 0.25% rate reduction on margin loans. Tiers apply. | Promotion Get up to $600 or more when you open and fund an E*TRADE account | Promotion None no promotion available at this time |

Get more smart money moves — straight to your inbox

Become a NerdWallet member, and we’ll send you tailored articles we think you’ll love.

Full Review

Where Interactive Brokers shines

IBKR Lite: Interactive Brokers has long been a popular broker for advanced traders, but in 2019, the company launched a second tier of service — IBKR Lite — for more casual investors. With IBKR Lite, you get unlimited free trades of stocks and exchange-traded funds that are listed on U.S. exchanges.

Investment selection: If you're interested in trading other investments, including options, futures, mutual funds, fixed income and more, you can do that on 135 exchanges in 33 countries with a Lite account, but the trading costs will be the same as what IBKR Pro investors pay.

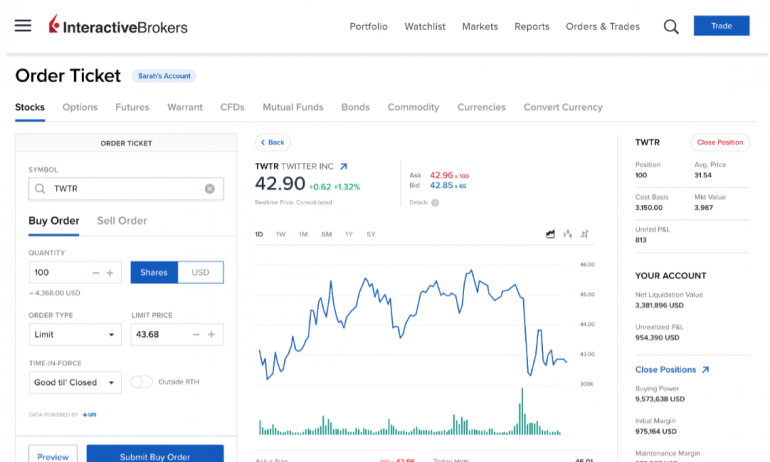

Advanced platform: As the name implies, IBKR Pro is geared toward advanced traders. If that's you, you'll probably like the broker's per-share pricing of $0.005 per share, advanced trading platform, and unmatched range of tradable securities — including foreign stocks.

Both tiers of service have a $0 account minimum and offer fractional shares of stock. IBKR Lite and IBKR Pro have no account maintenance or inactivity fees.

Where Interactive Brokers falls short

Website ease-of-use: Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing.

Interactive Brokers is best for:

Casual and advanced traders.

Day traders.

Margin accounts.

Options trading.

Research and data.

International investors.

Interactive Brokers at a glance

Account minimum | $0 |

Stock trading costs |

|

Options trades |

|

Account fees (annual, transfer, closing, inactivity) | None. |

Number of no-transaction-fee mutual funds | Over 4,000 U.S. no-transaction-fee mutual funds and over 14,000 offshore no-transaction-fee mutual funds. |

Tradable securities | • Stocks. • Bonds. • Mutual funds. • ETFs. • Options. • Fractional shares. • Futures. • Forex. • Metals. |

Crypto availability | Access to BTC, ETH, LTC, and BCH. |

Trading platform | IBKR Lite and IBKR Pro customers get access to Client Portal trading platform and powerful Trader Workstation platform at no charge. |

Mobile app | Advanced features mimic the desktop app, but iOS and Android user ratings are average. |

Research and data | Extensive research offerings, both free and subscription-based. |

Customer support options (includes how easy it is to find key details on the website) | Phone, email and chat support available from 8 a.m. to 8 p.m. Eastern time Monday through Friday, and 1 p.m. to 7 p.m. Sunday. |

Interactive Brokers in more detail

Account minimum: 5 out of 5 stars

Interactive Brokers allows you to open an account with no minimum required.

Stock trading costs: 5 out of 5 stars

If you're a casual investor, it’s hard to beat the free trades you'll enjoy with IBKR Lite. But even advanced traders who opt for IBKR Pro will like the low stock and ETF commission structure at Interactive Brokers, which favors frequent, high-volume traders at just $0.005 per share.

The broker also offers tiered pricing to lower rates even more. Investors who trade up to 300,000 shares a month can pay $0.0035 per share; tiered rates based on trading volume go as low as $0.0005 per share for clients who trade more than 100 million shares a month. Exchange and regulatory fees are extra on this plan.

Options trades: 4 out of 5 stars

Options trading is offered at competitive pricing, for both Pro and Lite customers, with a $.65 charge per contract and no base, plus Pro customers get discounts for larger volumes.

Account fees: 5 out of 5 stars

Interactive Brokers charges no annual, account, transfer or closing fees, which is relatively rare among brokers we review.

Number of no-transaction-fee mutual funds: 5 out of 5 stars

The retirement-investor set will be happy with the broker's impressive list of no-transaction-fee mutual funds — over 18,000 in all, above and beyond the vast majority of the broker's competitors.

Tradable securities available: 5 out of 5 stars

Interactive Brokers offers something for everyone here: Advanced traders will love the huge selection of products, including standard offerings of stocks, options and ETFs, precious metals, forex, warrants and futures.

Interactive Brokers also offers fractional shares. The ability to purchase a portion of a company's stock, rather than a full-priced share, makes it easier to invest in companies that have lofty share prices. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts.

Crypto availability: 5 out of 5 stars

Interactive Brokers introduced cryptocurrency trading in 2021, and the offering gives users 24/7 access to bitcoin, ethereum, litecoin and bitcoin cash. And while the service doesn't offer commission-free trading like some brokers do, the fees are pretty minimal, ranging from 0.12% to 0.18%, depending on monthly volume.

Trading platform: 5 out of 5 stars

The casual traders who find IBKR Lite appealing will find the Client Portal platform adequate for their trading needs. But both IBKR Lite and IBKR Pro traders seeking something more powerful can now enjoy access to Interactive Brokers’ Desktop Trader Workstation, which is considered one of the best trading platforms available for advanced traders.

The platform is fast and includes standard features such as real-time monitoring, alerts, watchlists and a customizable account dashboard. An options strategy lab lets you create and submit both simple and complex multileg options orders and compare up to five options strategies at one time.

Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Interactive Brokers For You notifications offer customized alerts about events that could affect a trader’s investments.

Worth noting: Another broker we review, Zacks Trade, offers its customers access to white-labeled versions of Trader Workstation. Zacks Trade charges higher trade commissions, but offers clients free calls with support reps who are licensed brokers. It's an option worth considering for traders who want the power of Interactive Brokers' trading platforms alongside a bit more personal support.

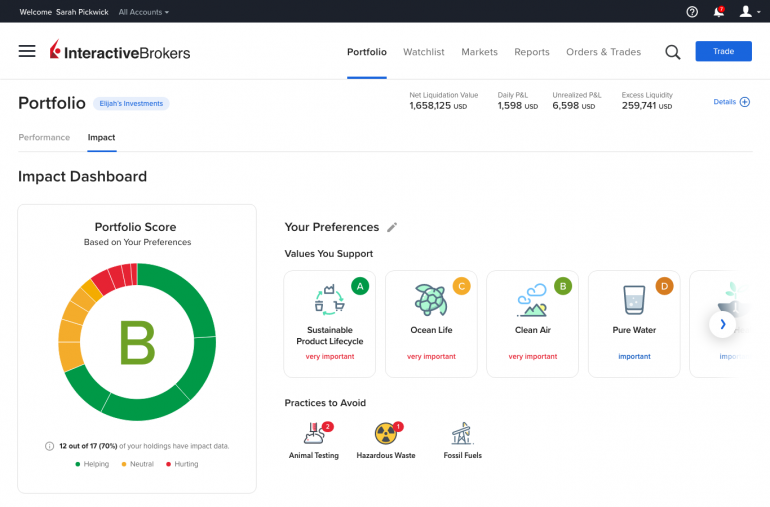

For investors looking to trade with a conscience, Interactive Brokers offers an Impact Dashboard, free to all users on Trader Workstation, the Client Portal or mobile apps. The dashboard allows investors to select their personal investment criteria from 13 principles (including clean air and water, LGBTQ inclusion and gender equality). Investors can also exclude investments based on 10 categories, such as animal testing, corporate political spending and lobbying, and hazardous waste production.

Mobile app: 3 out of 5 stars

The IBKR mobile app, available to both Lite and Pro customers, is Trader Workstation on the go, with advanced trading shortcuts, more than 400 data columns, option exercise and spread templates, news, research, charting and scanners. Users can create order presets, which prefill order tickets for fast entry. Presets set up on Trader Workstation are also available from the mobile app. However, the app gets fairly low ratings from both Android and iOS users.

In November of 2021, Interactive Brokers launched its IMPACT app, a values-focused trading application offering a mobile version of the Impact Dashboard described above. It has been rated positively by both Android and iOS users.

In March of 2022, Interactive Brokers introduced an additional app, IBKR GlobalTrader. It's aimed at global investors and lets investors trade stocks on more than 80 exchanges in North America, Asia and Europe. IBKR GlobalTrader is also available for both Android and iOS users. Unfortunately, it has received mixed reviews from both groups.

Research and data: 5 out of 5 stars

Interactive Brokers provides access to a huge selection of research providers and news services, many for free, including Fundamentals Explorer, which offers fundamentals data from Thomson Reuters on over 30,000 companies, plus more than 5,500 analyst ratings, and reports and newswires from more than 80 companies. Other research providers available to all clients include Zacks Investment Research, Morningstar Equity Ownership, Market Realist, 24/7 Wall Street and TheStreet. More than 100 additional providers are also available by subscription.

Customer support: 3.5 out of 5 stars

Interactive Brokers offers phone, email and chat support from 8 a.m. to 8 p.m. Eastern time Monday through Friday, and from 1 p.m. to 7 p.m. Sunday. However, there are no physical branches, so you won't be able to schedule an in-person meeting, if that's your preference.

While many brokerages are only open to U.S. investors, Interactive Brokers is available to investors in more than 200 countries and territories.

Other Interactive Brokers details you should know

Margin rates

Margin traders will benefit from the low rates at Interactive Brokers. For IBKR Pro customers, the maximum margin rate is 3.83%, and NerdWallet users get an extra 0.25 percentage point discount. For IBKR Lite, it's 4.83%. Those rates apply on balances between $0 and $100,000; the rates drop at higher balances. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. (Only U.S. residents who open and fund a new IBKR Pro account are eligible for the discounted margin rate.)

Is Interactive Brokers right for you?

Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. With the availability of free trades through IBKR Lite, even casual traders might find Interactive Brokers a strong contender. But beginner investors might prefer a broker that offers a bit more hand-holding.

How do we review brokers?

NerdWallet’s comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

For more details about the categories considered when rating brokers and our process, read our full methodology.

on Interactive Brokers' website