IRA vs. 401(k): How to Choose

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

IRA vs. 401(k): The quick answer

Both 401(k)s and IRAs — including Roth IRAs — have valuable tax benefits, and you can often contribute to both types of accounts.

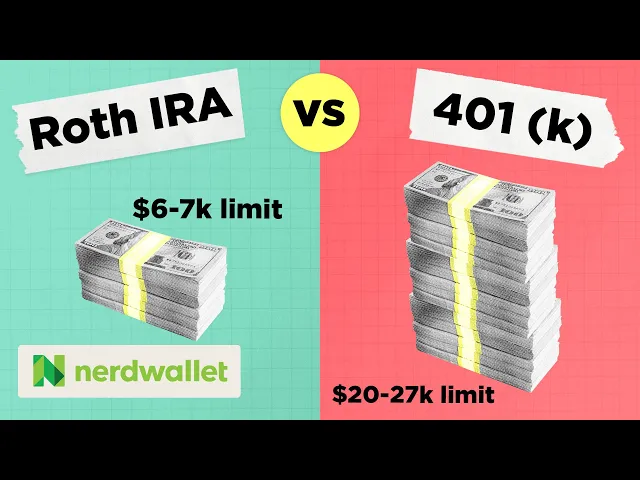

The main difference between 401(k)s and IRAs is that employers offer 401(k)s, but individuals open IRAs on their own, through a broker or bank. IRAs typically offer more investment options, but 401(k)s allow higher annual contributions.

The contribution limit for 401(k)s is $22,500 in 2023 ($30,000 if age 50 or older). The limit for IRAs is $6,500 in 2023 ($7,500 if age 50 and older).

If the IRA vs. 401(k) comparison is weighing on you, here’s a quick way to decide where to contribute first:

If your employer offers a 401(k) with a company match: Consider putting enough money in your 401(k) to get the maximum match. That match may offer a 100% return on your money, depending on the 401(k). For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year. Once you've done that, return to the 401(k) and resume contributions there.

If your employer doesn’t offer a company match: Consider skipping the 401(k) at first and start with an IRA or Roth IRA. You'll get access to a large selection of investments when you open your IRA at a broker, and you'll avoid the administrative fees that some 401(k)s charge. After contributing up to the IRA limit, think about funding your 401(k) for the pre-tax benefit it offers. Here's how and where to open an IRA. (Wondering which IRA is best for you? Here's how to choose between a Roth IRA and a Traditional IRA.)

Here's more on the pros and cons of IRAs vs. 401(k)s:

401(k) | Traditional IRA | Roth IRA | |

|---|---|---|---|

Contribution limit | $20,500 in 2022 and $22,500 in 2023 ($27,000 and $30,000 for those age 50 or older) | The combined contribution limit for all of your traditional and Roth IRAs is is $6,000 in 2022 and $6,500 in 2023 ($7,000 and $7,500 if age 50 or older) | |

Employer match | Many employers offer a match, typically around 3%. | None. | None. |

Tax treatment | Contributions lower taxable income in the year they are made. Distributions in retirement are taxed as ordinary income, unless a Roth 401(k). | If deductible, contributions reduce taxable income in the year they are made. Distributions in retirement are taxed as ordinary income. | No immediate tax benefit. Qualified withdrawals in retirement are tax-free. |

Eligibility | Eligibility is not limited by income. | Deduction phased out at higher incomes if you or your spouse are covered by a workplace retirement account. | Ability to contribute is phased out at higher incomes. Contributions can be withdrawn at any time. |

Investment availability | Funds in a 401(k) may be less expensive than identical funds purchased outside of 401(k). No control over plan and investment costs. Limited investment selection. | Large investment selection. | Large investment selection. |

Required minimum distributions | Required minimum distributions beginning at age 72 in 2022. That age rises to 73 in 2023, and will increase again to 75 in 2033. | Required minimum distributions beginning at age 72 in 2022. That age rises to 73 in 2023, and will increase again to 75 in 2033. | No required minimum distributions in retirement. |

Bottom line | Fund a 401(k) first if your company offers matching dollars. | Fund an IRA or Roth IRA first if your 401(k) doesn't offer a match. If you max out the IRA, begin contributions to your 401(k). | |

» Want to turn a 401(k) into an IRA? See the best IRA providers for a 401(k) rollover.

IRA vs. 401(k): A road map

Hats off to you if you have the means to max out both a 401(k) and a traditional IRA or Roth IRA. If not, this IRA vs. 401(k) road map will help you prioritize your dollars.

Your first step depends on whether your employer matches your contributions to your workplace savings account.

If your employer offers a 401(k) match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401(k) plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401(k). It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401(k) has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as it’s effectively a guaranteed return on those dollars. Also note that employer contributions don’t count toward the 401(k) annual contribution limit.

2. Next, contribute as much as you’re allowed to an IRA. Depending on which type of IRA you choose — Roth or traditional — you can get your tax break now or down the road when you start withdrawing funds for retirement.

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible — that means your taxable income for the year will be reduced by the amount of your contribution. But, if you're also covered by a 401(k), your deduction may be reduced or eliminated based on income. If you (or your spouse) has a workplace retirement plan, check out the IRA limits.

A Roth IRA is a good choice if you’re not eligible to deduct traditional IRA contributions, or if you don't mind giving up the IRA's immediate tax deduction in exchange for tax-free growth on your investments and tax-free withdrawals in retirement. Roth IRA eligibility is not affected by participation in a 401(k), but there are income limits. You can see the latest Roth rules on our IRA limits page.

» Stuck between the two? See our Roth IRA vs. traditional IRA comparison

3. After maxing out a traditional IRA or Roth IRA, revisit your 401(k). Even after you’ve gotten the employer match — and even if your investment choices are limited, which is one of the main drawbacks of workplace retirement plans — a 401(k) is still beneficial because of the tax deduction.

The money you contribute to a 401(k) will lower your taxable income for the year dollar for dollar. And don’t forget about the added benefit of tax-deferred growth on investment gains.

Fees $0 per trade | Fees 0% management fee | Fees $0 no account fees to open a Fidelity retail IRA |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion Up to $600 when you invest in a new Merrill Edge® Self-Directed account. | Promotion Free career counseling plus loan discounts with qualifying deposit | Promotion Get $100 when you open a new Fidelity retail IRA with $50. A 200% match. Use code FIDELITY100. Limited time offer. Terms apply. |

AD Paid non-client promotion |

If your employer doesn’t offer a 401(k) match

1. Contribute to a traditional or Roth IRA first. Not all companies match their employees' retirement account contributions. When that’s the case, choosing an IRA — and contributing up to the max — is generally a better first option.

Why start with an IRA? One of the biggest benefits of an IRA is that it offers access to a virtually unlimited number and type of investments, giving you much more control over your investment options: You can bargain-shop for low-cost index mutual funds and ETFs instead of being restricted to the offerings in a workplace retirement account, and you can avoid paying the administrative fees that many 401(k) plans charge.

2. After maxing out IRA benefits, contribute to your 401(k). Here again, the tax deferral benefit of a company-sponsored plan is a good reason to direct dollars into a 401(k) after you’ve funded a traditional or Roth IRA.

Only in the worst cases — a retirement account with truly crummy, high-fee investment choices and high administrative costs — would it be advisable to completely avoid your company plan.

Remember that if your income passes certain thresholds and you or your spouse put money into a workplace plan, your ability to deduct traditional IRA contributions may be reduced or eliminated. If you aren’t eligible for a traditional IRA deduction, you may still be eligible for a Roth IRA. Also, even if you’re not eligible to deduct your traditional IRA contribution, you can make nondeductible contributions and still benefit from tax-deferred investment growth. And it's possible to convert an IRA to a Roth IRA by using a so-called backdoor Roth IRA.

» Ready to open an IRA? Check out our round-up of top IRA accounts