TaxSlayer Review 2023

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

TaxSlayer's pricing model sets it apart: The company charges according to the level of support you want, rather than according to a software package’s capabilities. In other words, the cheapest paid package handles all the same tax situations and forms that the most expensive package handles — what changes is how much help you can get.

Translation: If you’re a confident tax filer and don’t need a lot of support, you could save a lot of money with TaxSlayer.

| |

FREE | $0 for federal and one state return Allows you to file a 1040 and a state return for free, but only if you have a very simple tax situation: your taxable income is under $100,000, you don’t claim dependents, you don’t itemize, you don’t have investments, rental income or a business, and you don’t take the earned income tax credit. |

PAID PACKAGES | Classic Federal: $19.95 +$39.95 per state filed All forms, deductions and credits. Premium Federal: $39.95 + $39.95 per state filed All forms, deductions and credits. Includes Ask a Tax Pro and live chat, phone and email support. Self-Employed Federal: $49.95 + $39.95 per state filed Includes personal and business income and expenses, 1099 and Schedule C. Includes all the tax support in the Premium tier. Promotion: NerdWallet users get 30% off federal filing costs. Use code NERD30. |

One note about prices: Providers frequently change them and may offer discounted services and packages toward the beginning of tax-filing season. These markdowns tend to get replaced with surge pricing the closer we get to April. We base our reviews on the list prices and not the discounts to reflect this. You can verify the latest price by clicking through to TaxSlayer’s site.

TaxSlayer's prices

Price is a huge advantage for TaxSlayer. People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. You also might prefer TaxSlayer if you hate that bait-and-switch feeling people often experience when they get halfway through their tax returns and find out they have to upgrade because they need to fill out certain tax forms. TaxSlayer’s paid packages all handle the same forms — what determines the price is the level of support you want.

What you get from TaxSlayer's free version

TaxSlayer offers a free version that lets you file a simple Form 1040, but you can’t itemize or file various other schedules, which means it probably won’t work for you if you plan to do things such as make itemized deductions, report business or freelance income, report stock sales or income from a rental property.

And TaxSlayer imposes other requirements: Your taxable income must be under $100,000, you have to file as single or married filing jointly, and you cannot claim dependents or the earned income tax credit. Most people will probably need to get one of the paid versions.

TaxSlayer's ease of use

How it works

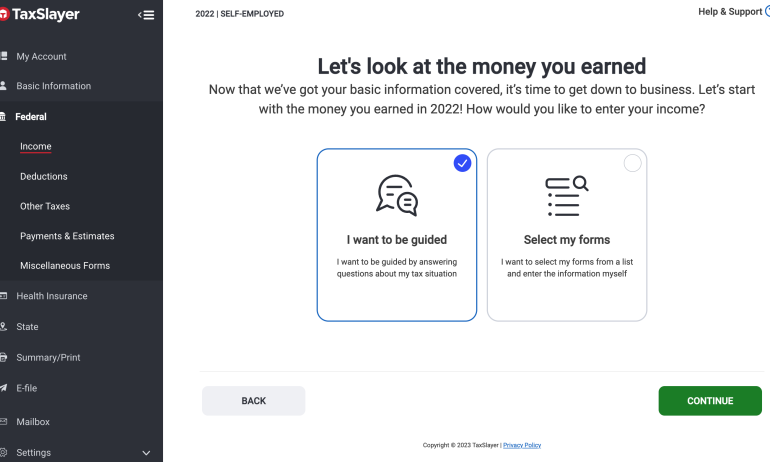

TaxSlayer first asks if you’d like to be guided through the process or if you’d like to choose which forms to upload. If you choose the guided option you’ll answer a series of easy questions such as if you have any W-2s to enter, if you have interest or dividend income to report, or if you took money out of a retirement account.

Questions are phrased simply, and tax jargon is kept to a minimum. This makes the process of filing taxes fairly seamless. You simply answer questions and your return gets filled in behind the scenes.

Like with other tax software, you’ll answer questions about your income, deductions, your health insurance and any state information.

Note: Like most other tax prep providers, TaxSlayer doesn’t make it especially easy to downgrade to a lower-tiered package. If you find that you’ve accidentally started working with, say, the Premium version, and then realize the Classic might suit your needs, you can’t just click a button and change package types. According to the provider, the easiest way to downgrade is to contact TaxSlayer’s support staff.

What it looks like

TaxSlayer’s interface looks like other, more expensive versions on the market. There’s an interview process, but you can skip around pretty easily if you need to.

Embedded "learn more" links appear frequently to offer tips and explanations, and the on-screen help button does a decent job of laying out all the available support options.

Handy features

You can switch from another provider: TaxSlayer imports last year’s return from another provider, but only if it’s a PDF, and you can only bring over your 1040 (rather than all the supporting forms and schedules that may go with it).

Auto-import certain tax documents: You can import your W-2, 1099-NEC, and 1099-MISC information directly into your return.

Donation calculator: Unlike competitors, there’s no tool to help you calculate the deduction value of items you donate to charity.

Platform mobility: Because the software is online only, you can log in from other devices if you’re working on your return here and there. The provider also has a mobile app.

TaxSlayer's support options

Here’s a look at the various ways you can find answers and get guidance when filing your return with TaxSlayer.

Ways to get help

General guidance: Searchable knowledge base.

Tech support: Free tech support by email or phone; also live chat for Premium and Self-Employed packages.

One-on-one tax help: Access to on-demand tax help (written or over the phone) from tax professionals for Premium and Self-Employed packages.

TaxSlayer’s human tax help

TaxSlayer’s paid packages vary by support level, not functionality. Notable is that although phone and email tech support are free, the more valuable kind of help — tax help — is free only for Premium and Self-Employed users. That service is called Ask a Tax Pro, and users submit their questions through their TaxSlayer accounts; it’s not an on-screen experience like some other providers offer. The tax pro contacts them within one business day via phone or email.

TaxSlayer says its tax pros "are highly qualified individuals with extensive knowledge in both the American tax code and TaxSlayer’s software. Our tax pros are IRS-certified with advanced experience in tax law, return preparation, and the tax industry." Self-Employed package users get access to tax pros who specialize in self-employment.

If you're audited

Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between "support" and "defense." With most providers, audit support (or "assistance") typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

The Classic tier includes help with IRS inquiries for up to one year after the return is accepted. TaxSlayer’s Premium and Self-Employed packages come with free audit assistance for three years. Self-Employed also includes Audit defense, which includes legal representation from a tax pro in the case of an IRS audit for up to three years.

Users can also buy SecurelyID, an identity protection package, for $39.99.

If you're getting a refund

No matter how you file, you can choose to receive your refund several ways:

A direct deposit to a bank account is the fastest option. TaxSlayer also allows you to split refunds across multiple bank accounts. You can also have it loaded onto a Visa Green Dot Bank prepaid debit card (if you’re getting a refund on your state taxes, see if your state offers a prepaid card option as well) or sent as a paper check.

Other options include applying the refund to next year’s taxes, or directing the IRS to buy U.S. savings bonds with your refund.

You have the option of paying for the software out of your refund. But there’s a $39.95 charge to do that.

How does TaxSlayer compare?

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

| |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

Promotion: NerdWallet users get 30% off federal filing costs. Use code NERD30. |

The bottom line

TaxSlayer may not have the name recognition of behemoth brands such as TurboTax and H&R Block, but it offers attractive and usable software at great price points. However, if meaningful real-time access to a tax pro is important to you, competitors might appeal more.

NerdWallet’s comprehensive review process evaluates and ranks the largest online tax software providers. Our aim is to provide an independent assessment of available software to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers, do first-hand testing and observe provider demonstrations. Our process starts by sending detailed questions to providers. The questions are structured to equally elicit both favorable and unfavorable responses. They are not designed or prepared to produce any predetermined results. The provider’s answers, combined with our specialists’ hands-on research, make up our proprietary assessment process that scores each provider’s performance.

The final output produces star ratings from poor (1 star) to excellent (5 stars). Ratings are rounded to the nearest half-star. For more details about the categories considered when rating tax software and our process, read our full methodology.