Travel Insured International Review

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When thinking about your next vacation, giving some thought to travel insurance can make a lot of sense. It can protect you in case something goes wrong, not to mention give you peace of mind. One travel insurance provider to consider is Travel Insured International, a company with over 25 years in this space. In 2015, it was acquired by Crum & Forster, a nearly 200-year-old specialty and standard insurance provider.

Here’s what you need to know about Travel Insured International.

What does Travel Insured International offer?

Travel Insured International offers four plans to choose from: Worldwide Trip Protector Plus, Worldwide Trip Protector, Worldwide Trip Protector Lite and Travel Medical Protector.

The plans include trip cancellation, trip interruption/delay, medical protection, baggage protection, rental car coverage, cancel-for-any-reason coverage and various optional add-ons.

What does it cost?

To see how the policies shake out, we input a $3,000, three-week trip to Mexico by a 45-year-old resident of Alaska:

Coverage | Worldwide Trip Protector Plus | Worldwide Trip Protector | Worldwide Trip Protector Lite | Travel Medical Protector |

Trip cancellation | 100% | 100% | 100% | - |

Reimbursement of miles or reward points | $250 | $250 | $250 | - |

Cancel for any reason (CFAR) | 75% of trip cost | - | - | - |

Trip interruption | 150% | 150% | 100% | $5,500 |

Travel delay | $1,000 ($200 daily limit / minimum 6-hour delay required) | $1,000 ($200 daily limit / minimum 6-hour delay required) | $300 ($100 daily limit / minimum 12-hour delay required) | $1,000 ($200 daily limit / minimum 6-hour delay required) |

Missed connection | $500 after 3 hours | $500 after 3 hours | $300 after 12 hours | - |

Change fee coverage | $250 | $250 | $250 | - |

Itinerary change | $500 | $500 | - | - |

Interrupt for any reason | 75% of trip cost | - | - | - |

Accident & sickness medical expense | $100,000 | $100,000 | $10,000 | $50,000 |

Emergency medical evacuation and repatriation | $1 million | $1 million | $100,000 | $1 million |

Accidental death and dismemberment (AD&D) 24 hour | $10,000 | $10,000 | - | - |

Air flight only AD&D | - | - | - | $50,000 |

Baggage & personal effects | $1,000 | $1,000 | $750 | $1,000 |

Baggage delay | $300 after 12 hours | $300 after 12 hours | $200 after 24 hours | $300 after 12 hours |

Rental car damage | $50,000 | - | - | - |

Non-medical emergency evacuation | $150,000 | $150,000 | - | $150,000 |

Policy cost | $216.00 | $144.00 | $109.00 | $73.50 |

% of trip cost | 7.20% | 4.80% | 3.63% | 2.45% |

The Worldwide Trip Protector Plus plan ($216) and the Worldwide Trip Protector plan ($144) are nearly identical in the benefits offered, with both providing 100% trip cancellation, 150% trip interruption, $1,000 travel delay, $1 million in medical evacuation, $100,000 for medical expenses and many other benefits.

The primary difference between the two plans is that the more expensive option includes CFAR coverage and interrupt-for-any-reason coverage.

CFAR allows you to cancel a trip for nearly any reason and receive up to 75% of your nonrefundable deposit back (so long as you cancel within 48 hours before departure and you add all of your travel arrangements to your trip within 21 days of payment). This is a great option for those who have nonrefundable reservations and want the flexibility to cancel a trip on the fly.

IFAR allows you to interrupt your trip for any reason as long as it is 72 hours or more after you’ve departed. If you use this benefit, you will receive a refund of up to 75% of your nonrefundable and unused land or water travel arrangements. This could be useful coverage if you decide to cut your trip short and the reason for interruption is not considered a covered reason as per the policy.

If you value these two benefits, you’d want to go with the more expensive Worldwide Trip Protector Plus plan.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

The Worldwide Trip Protector Lite plan ($109) offers 100% trip cancellation coverage, 100% trip interruption, $300 travel delay, $100,000 medical evacuation and repatriation and $10,000 for medical expenses and other benefits.

The limits offered by this plan are lower; however, if you’re only looking for trip cancellation benefits and the medical coverage is sufficient for you, this policy could make sense.

The Travel Medical Protector plan ($73.50) focuses mostly on providing benefits surrounding medical care, with $1 million for medical evacuation and repatriation, $50,000 for medical expenses, $150,000 for non-medical evacuation and $5,000 for trip interruption.

This policy could be a good choice for someone who doesn't need trip cancellation benefits. Additionally, if you have a premium travel card that offers trip cancellation insurance (like the Chase Sapphire Reserve® or The Platinum Card® from American Express) and the limits are sufficient, a standalone medical plan might be enough to provide adequate coverage for your trip.

Additional options and add-ons

Optional Add-ons | Worldwide Trip Protector Plus | Worldwide Trip Protector | Worldwide Trip Protector Lite | Travel Medical Protector |

Cancel for work reason | - | - | Cost: $24/traveler | - |

Flight accident | Cost: $8/traveler; Coverage limit: $100,000 | Cost: $8/traveler; Coverage limit: $100,000 | Cost: $8/traveler; Coverage limit: $100,000 | - |

Medical | - | - | Cost: $25/traveler | Cost: $1.47; Coverage limit: $100,000 |

Rental car damage | - | Cost: $7/day; Coverage limit: $50,000 | Cost: $7/day; Coverage limit: $25,000 | - |

Primary coverage upgrade | - | Cost: $25/traveler | - | - |

Travel benefits upgrade | Cost: $35/traveler | Cost: $35/traveler | - | - |

Travel Insured International allows you to upgrade certain elements of your policy, including: cancel for work reason, flight accident, medical, rental car damage, primary coverage and travel benefits.

These add-ons are a great way to improve limits on specific items of coverage. For example, for $35 per person, the Worldwide Trip Protector Plus plan and the Worldwide Trip Protector plan let you double your trip delay, missed connection, baggage delay and baggage and personal effects limits.

For $24 per person, the Worldwide Trip Protector Lite plan allows you to add a cancel-for-work-reason benefit. Cancel for work reason would permit you to cancel a trip if it's related to work. The reason will need to satisfy the conditions of the policy, but if this is a benefit you’d like to have, it's good to know it's available.

How to find a policy

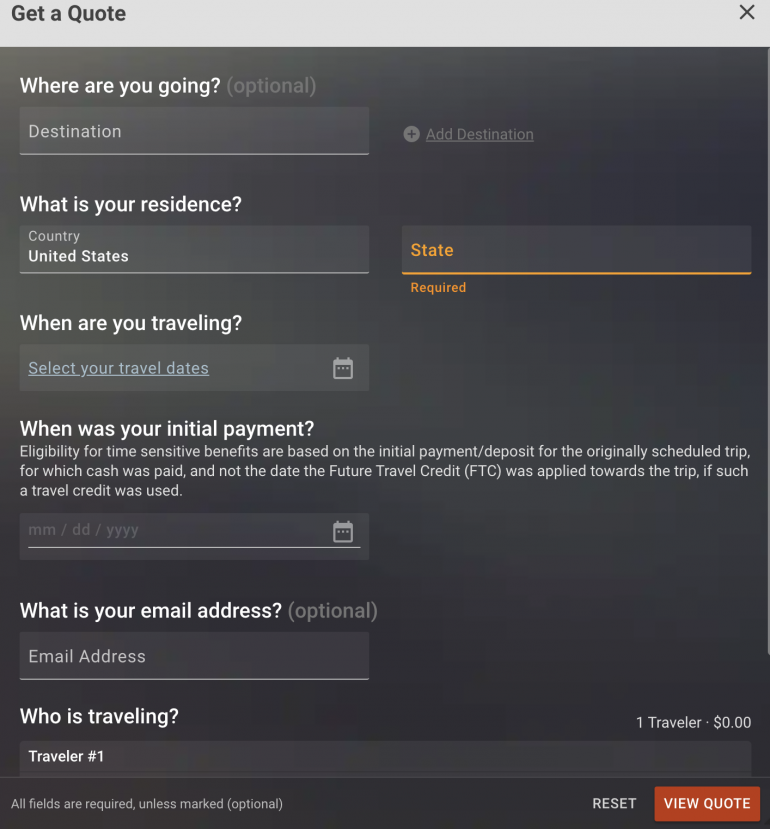

To see which policies are available in your state, head over to the Travel Insured International website, input your destination and click “Get a Quote.” You will then need to input the following trip details, like your residence, your trip dates and the number of travelers.

Once you select “View Quote,” you will see a list of plans to choose from based on your state of residence and trip details.

What’s not covered

Though all of the above plans offer varying levels of coverage, not everything will be covered, including:

Being scared to travel. Unless you have the CFAR add-on, you can only cancel your trip for a covered reason under the policy. Being nervous about your travels is not a covered reason, so if you’d like ultimate flexibility, you’d want to choose the Worldwide Trip Protector Plus plan.

Baggage loss for eyeglasses, contact lenses, hearing aids or orthodontic devices. Keep these items with you in a carry-on or backpack because a Travel Insured International policy won’t cover them.

Certain events. General exclusions not usually covered by insurers won't be covered here either. Example events include self-harm, war, participating in dangerous activities (e.g., skydiving), committing a felony or getting into an accident while intoxicated. You’ll need to review the policy's fine print to know exactly what is and isn’t covered.

Who should get a Travel Insured International policy?

If you’re heading on a major international vacation and you don’t have a premium travel credit card with sufficient limits, considering a Travel Insured International insurance policy could be a good bet.

The CFAR and IFAR options are solid benefits for those who want ultimate flexibility — especially since you can add coverages like these a la carte. If you’re looking for fewer benefits with lower limits, the Worldwide Trip Protector Lite plan is a good choice. Those seeking medical coverage can consider the Travel Medical Protector plan.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card