Travelex Travel Insurance: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

It can make a lot of sense for trip planners to get a travel insurance policy, as it can safeguard your nonrefundable deposits and protect you in case of an emergency. One provider is Travelex, which offers several travel insurance plans and flight insurance plans, plus customizable add-ons like Cancel For Any Reason and Adventure Sports Coverage.

The insurer is headquartered in Omaha, Nebraska, and was founded in 1996 when Travelex Group acquired the travel insurance division of Mutual of Omaha.

Note: Although it shares a similar name, Travelex Insurance Services is not affiliated with the Travelex money exchange stores and kiosks commonly found in airports.

About Travelex coverage

Travelex offers three travel insurance plans and two flight insurance plans.

Of the three travel insurance plans, the Travel America plan costs $60 and is designed for domestic trips up to 14 days in length. The Travel Basic and Travel Select plans can be purchased for longer domestic and international trips, and the cost of the policy varies based on trip cost.

Coronavirus coverage by Travelex

Travelex plans provide coverage for coronavirus-related events that occur before or during your trip. If, for example, you become ill with COVID-19 while traveling and are diagnosed by a physician, you’ll be eligible for trip delay, trip interruption, emergency medical and evacuation benefits.

» Learn more: Does my travel insurance cover coronavirus?

Travelex insurance plans

Domestic and international trips: Travel Basic and Travel Select

To compare the Travel Basic and Travel Select plans, we sought a quote for a $5,000, two-week trip to Switzerland by a 43-year-old Texas resident.

The Travel Basic plan was quoted as $239 (4.8% of the total trip cost), whereas the Travel Select coverage was quoted $319 (6.4% of total trip cost).

Here is what this traveler can expect, broken down by plan and by coverage type.

Coverage | Travel Basic | Travel Select |

|---|---|---|

Trip cancellation | 100% of insured trip cost. | 100% of insured trip cost. |

Trip interruption | 100% of insured trip cost. | 150% of insured trip cost. |

Trip interruption — return air only | - | $1,000. |

Frequent traveler benefit | $200. | - |

License fee reimbursement | - | License cost. |

Trip delay | $500 ($250/day). | $2,000 ($250/day). |

Missed connection | $500. | $750. |

Baggage & personal effects | $500. | $1,000. |

Baggage delay | $100. | $200. |

Emergency medical expense | $15,000. | $50,000. |

Dental sublimit | $500. | $500. |

Sporting equipment delay | - | $200. |

Emergency medical evacuation | $100,000. | $500,000. |

AD&D | $10,000. | $25,000. |

Kids-included pricing | No. | Yes; available (max trip cost of $10,000 per person). |

Travel assistance | Included. | Included. |

Maximum trip cost | $10,000. | $50,000. |

Maximum trip length | 30 days. | 364 days. |

Travel Basic ($239 or 4.8% of total trip cost)

The Basic plan is Travelex’s introductory level trip insurance plan and covers trips up to 30 days in length. The plan offers 100% trip cancellation, 100% trip interruption, $15,000 emergency medical and $100,000 medical evacuation, among other benefits. When purchasing this plan, the following upgrades are available:

Car Rental Collision: Provides added financial protection in case you’re in an accident or collision while driving a rental car.

AD&D Common Carrier (Air Only): Accidental death and dismemberment insurance provides coverage in case of physical injury or death that occurs while riding, boarding or descending a certified aircraft.

Travel Select ($319 or 6.4% of total trip cost)

This is Travelex’s most comprehensive plan and covers trips up to 364 days. This option offers the highest levels of coverage, with 100% trip cancellation, 150% trip interruption, $50,000 emergency medical and $500,000 medical evacuation, along with other coverage.

Additionally, all children 17 and younger are covered free of charge when accompanied by a covered adult. The Travel Select plan is a good choice for those traveling with family and who are looking for the highest limits, along with the most options for add-ons.

When choosing this plan, the following add-ons are offered:

Cancel For Any Reason: Allows you to cancel your trip for any reason whatsoever and get up to 50% of your nonrefundable deposits back (as long as the trip is canceled 48 hours or more before the scheduled departure date). This add-on must be purchased at the same time as the initial plan and within 15 days of the first trip payment.

Additional medical insurance: Provides $50,000 in medical expense coverage and $500,000 in medical evacuation benefits in addition to what is already included in the policy.

Adventure sports coverage: Offers coverage for specific activities, such as kayaking, scuba diving, bungee jumping and more.

Car Rental Collision: Same as Travel Basic plan.

AD&D Common Carrier (Air Only): Same as Travel Basic plan.

Domestic trips: Travel America ($60 for 14 days maximum)

The Travel America plan is designed for those who want to take domestic trips no longer than 14 days in length. Trip cancellation and interruption coverage is limited to $750 and $1,125, respectively, which is something to keep in mind when you consider this policy.

If you’re booking a domestic trip that costs $2,000 and you need to cancel for a covered reason, the maximum you’d get back is $750.

The following limits apply to the Travel America plan:

Benefit | Travel America |

|---|---|

Trip cancellation | 100% of trip cost up to $750. |

Trip interruption | 150% of trip cost up to $1,125. |

Trip delay | $2,000. |

Missed connection | $2,000. |

Emergency medical & dental expense | $50,000. |

Emergency medical evacuation & repatriation | $100,000. |

Baggage & personal effects | $250,000. |

Baggage delay | $1,000. |

Sporting equipment delay | $2,000. |

AD&D | $25,000. |

Kids-included pricing | All coverages shared between the insured and up to seven traveling companions. |

Travel assistance | Included. |

Pet medical expense | $1,000 ($50 deductible). |

Pet return | $10,000. |

Flight insurance plans: Flight Insure and Flight Insure Plus

Travelex offers two flight insurance plans: Flight Insure and Flight Insure Plus. These plans are designed for those who are looking for coverage from the time the flight takes off until it touches down. Both plans provide access to 24/7 travel assistance.

To get an estimate of the costs, we used the same $5,000, two-week trip to Switzerland by a 43-year-old Texas resident. Flight Insure came out to $17 (0.3% of trip cost) and Flight Insure Plus would cost $39 (0.8% of trip cost).

This is how that coverage varies across plans:

Coverage | Flight Insure | Flight Insure Plus |

|---|---|---|

AD&D Common Carrier (Air Only) | Select coverage; $300,000, $500,000, $1 million. | Select coverage; $300,000, $500,000, $1 million. |

Trip delay | $100. | $100. |

Baggage & personal effects | - | $1,000. |

Baggage delay | - | $500. |

Emergency medical & dental expense | - | $10,000. |

Dental sublimit | - | $500. |

Emergency medical evacuation & repatriation | - | $100,000. |

Travel assistance | Included. | Included. |

Maximum trip cost | N/A. | N/A. |

Maximum trip length | 180 days. | 180 days. |

Flight Insure ($17 or 0.3% of trip cost)

The Flight Insure plan is a great option for those who only want trip delay and flight accident coverage.

Flight Insure Plus ($39 or 0.8% of trip cost)

In addition to including all the coverage from the Flight Insure plan, the Flight Insure Plus plan also includes baggage delay and loss, emergency medical and repatriation coverage.

» Learn more: What to know before buying travel insurance

What isn’t covered by Travelex

Travel insurance policies include various exclusions that are helpful to be aware of so you know exactly what type of coverage you’re purchasing.

Here are some general exclusions outlined by Travelex:

Travel for medical treatment: Traveling for the purpose of receiving medical treatment is not covered.

Intentional acts: Losses sustained from self-inflicted injuries, unlawful acts, intoxication and drug use.

Participation in professional sports: Motor sports, motor racing and partaking in professional athletic events are excluded. However, if the adventure sports add-on is purchased, specific activities could be covered.

Exclusions may vary based on the policy chosen and which state you live in, so review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Does travel insurance cover award flights?

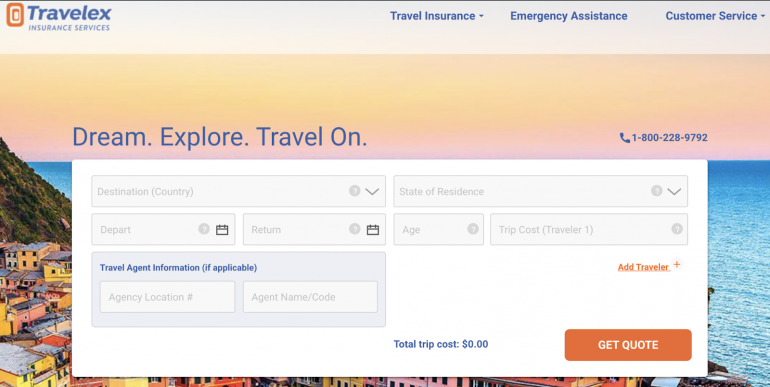

How to choose a Travelex plan online

Head over to the Travelex Travel Insurance website and input your trip details.

On the next page, you’ll see your travel insurance and flight insurance plan options along with the policy details.

» Learn more: The majority of Americans plan to travel in 2022

Which Travelex travel insurance policy is best for me?

Decide which coverage you’re looking for so you choose the right plan.

For expensive, international family trips: The Travel Select plan provides coverage for the insured and all children age 17 and under when accompanied by the adult. This comprehensive plan also has the highest limits and allows for the purchase of various add-ons.

For those who want basic travel insurance coverage when going abroad: Although it doesn’t have the highest limits, the Travel Basic plan is a good, comprehensive travel insurance option when you don’t need to insure any children and you’re satisfied with the existing limits.

For domestic travel: If you’re going on a trip within the U.S. and want basic travel insurance coverage, the Travel America option is a great choice at only $60 for trips up to 14 days.

If you have a premium travel credit card that provides complimentary trip insurance benefits, take a moment to familiarize yourself with the coverage you have so you don’t purchase a policy you don’t need.

» Learn more: The best travel insurance companies

For example, the Chase Sapphire Reserve® offers $10,000 per trip and $40,000 per year in trip cancellation benefits, and $2,500 for emergency medical coverage. If you hold this card and your trip is more expensive or you’d like higher emergency medical benefits, you’d want to consider a comprehensive travel insurance policy. Otherwise, charge the trip to your card and use the built-in benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card