Traditional IRA Definition, Rules and Options

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

What is a traditional IRA?

A traditional IRA is an account that allows you to make pre-tax contributions, and the money in the account grow tax-deferred. You don't pay income taxes on your investments until you withdraw from your IRA in retirement.

How does a traditional IRA work?

Here are the key characteristics of traditional IRAs and general concepts.

You open a traditional IRA at a brokerage, robo-advisor or bank. If you get one from a broker, you’ll be able to invest in stocks and bonds; IRAs from banks generally offer certificates of deposit and savings accounts.

You invest the money in your account. You can invest in stocks, bonds and other assets. How much your account grows per year and whether you lose money depends on how you invest. For a long-term goal such as retirement, stocks and bonds can be a sensible choice because of their higher historical returns. (See how to invest your IRA for simple investment tips.)

Contribution limits. You can contribute up to $6,000 in 2022 and up to $6,500 in 2023, even if you’re also contributing to a 401(k) or other workplace savings plan. Those 50 or older can contribute an additional $1,000 per year. Generally, you (or your spouse) must have earned income to contribute to an IRA. You can also add to your IRA by rolling over money from another retirement account.

Contributions may be tax-deductible. For example, if your income is $60,000 and you contribute $6,000 to a traditional IRA, then your taxable income that year will drop to $54,000, assuming you qualify for the tax deduction (more on that below).

Withdrawal rules. You're not taxed on gains until you withdraw them. Early withdrawals may be taxed as income and assessed a 10% penalty.

Traditional IRAs aren't the same as Roth IRAs. With Roth IRAs there’s no tax deduction when you make contributions, but your withdrawals come out tax-free in retirement. You don't pay taxes on your investment earnings, as long as you follow the Roth IRA rules.

» Compare Roth IRAs vs. traditional IRAs

Fees $0 per trade | Fees 0% management fee | Fees $0 no account fees to open a Fidelity retail IRA |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion Up to $600 when you invest in a new Merrill Edge® Self-Directed account. | Promotion Free career counseling plus loan discounts with qualifying deposit | Promotion Get $100 when you open a new Fidelity retail IRA with $50. A 200% match. Use code FIDELITY100. Limited time offer. Terms apply. |

AD Paid non-client promotion |

Here's how to open a traditional IRA account

Two popular ways to get an IRA are through brokers and robo-advisors.

Brokers. This is the hands-on approach for those who want to choose their own investments. With an online broker, you’ll select from investments accessible through that provider, including stocks, bonds and mutual funds.

Robo-advisors. If choosing your own investments sounds too daunting, consider the hands-off approach, a robo-advisor. These providers, which now include many of the most recognizable names in investing, use automated technology to choose investments based on your goals and investing horizon, all for a fraction of what a traditional investment manager might charge.

» See our roundup of the best IRA providers, divided by hands-on brokers and hands-off robo-advisors

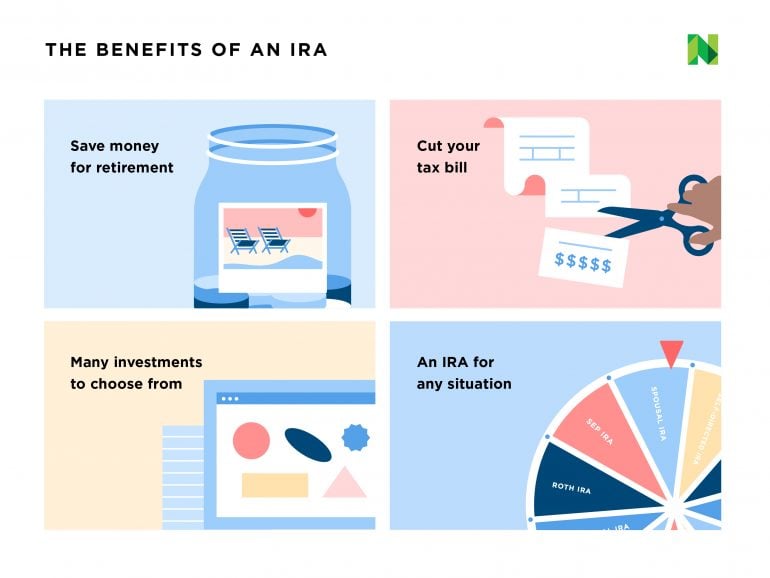

What is the benefit of a traditional IRA?

These accounts have more benefits than drawbacks. Here are some of the pros and cons:

PROS | CONS |

|---|---|

|

|

Traditional IRA distributions and withdrawals

Here's the basic overview:

Generally, you can start taking distributions from a traditional IRA when you reach age 59 1/2.

You pay regular income tax on distributions from your traditional IRA. (See what tax bracket you're in.)

If you take money out of your traditional IRA before age 59 1/2, you may have to pay a 10% early withdrawal penalty. There are some exceptions to this early withdrawal penalty, such as needing the money for college, buying a house or other reasons.

You don't have to start taking distributions from your traditional IRA just because you reached your 59 1/2 birthday. You can wait. However, you can't wait forever; you must start taking required minimum distributions (RMDs) when you reach age 73.

Who is eligible for a traditional IRA?

The good news: Everyone can open and contribute to a traditional IRA. The bad news: Not everyone is eligible to deduct contributions to a traditional IRA.

Qualifying for a traditional IRA when you have a 401(k) or other employer plan

If you or your spouse has a retirement plan at work, the amount of your traditional IRA contribution that you can deduct is reduced, or eliminated altogether, once you hit a certain income. You can still make contributions, but they won’t be tax-deductible.

If you, and your spouse if you're married, don't have retirement plans at work, then you can deduct your IRA contribution no matter how much your income.

Note: The income limits apply to your modified adjusted gross income (MAGI), which is your adjusted gross income with some deductions and exclusions added back in. See IRS Publication 590-A, Worksheet 1-1, for complete instructions on figuring MAGI for traditional IRAs.

Traditional IRA limits in 2022 and 2023

These income limits apply only if you (or your spouse) have a retirement plan at work.

Filing status | 2022 or 2023 income range | Deduction limit |

|---|---|---|

Single or head of household (and covered by retirement plan at work) | 2022: $68,000 or less. 2023: $73,000 or less. | Full deduction. |

2022: More than $68,000, but less than $78,000. 2023: More than $73,000, but less than $83,000. | Partial deduction. | |

2022: $78,000 or more. 2023: $83,000 or more. | No deduction. | |

Married filing jointly (and covered by retirement plan at work) | 2022: $109,000 or less. 2023: $116,000 or less. | Full deduction. |

2022: More than $109,000, but less than $129,000. 2023: More than $116,000, but less than $136,000. | Partial deduction. | |

2022: $129,000 or more. 2023: $136,000 or more. | No deduction. | |

Married filing jointly (spouse covered by retirement plan at work) | 2022: $204,000 or less. 2023: $218,000 or less. | Full deduction. |

2022: More than $204,000, but less than $214,000. 2023: More than $218,000, but less than $228,000. | Partial deduction. | |

2022: $214,000 or more. 2023: $228,000 or more. | No deduction. | |

Married filing separately (you or spouse covered by retirement plan at work) | 2022 and 2023: Less than $10,000. | Partial deduction. |

2022 and 2023: $10,000 or more. | No deduction. |

Should I contribute to a traditional IRA if I can’t deduct it?

Nondeductible IRA contributions can still be valuable: Money for retirement is money for retirement, and your investment earnings will still grow tax-deferred. But this can also be a headache: You are responsible for keeping track of after-tax contributions by filing IRS Form 8606 each year so you’re not taxed again on that money when you take retirement distributions.

In short, there are better options you should max out before going down the nondeductible IRA road. They are:

A Roth IRA, if you’re eligible. These accounts have income eligibility rules, but they are higher than the limits to deduct traditional IRA contributions. See our IRA limits page.

Your employer-sponsored retirement plan. Consider maxing that account out before making nondeductible IRA contributions. That could actually make you eligible for an IRA deduction because your contributions to the workplace plan lower your taxable income for the year.

If after exhausting both of those options, you still want to consider the nondeductible route, see our page on nondeductible IRAs.

Other types of IRAs

The are other popular types of IRAs out there, such as Roth, SEP and SIMPLE. But there are also these types of IRAs: backdoor Roth, spousal, self-directed, inherited and rollover. You can learn more about each of these IRAs and more in our IRA guide.

FAQs