The Guide to World Nomads Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

World Nomads offers the Standard and Explorer travel insurance plans and excels in sports/activity related travel insurance coverage while offering solid trip delay, baggage delay and lost luggage protections. The provider offers insurance plans for travel to nearly any country and is available to residents of most countries. In the U.S., World Nomads policies are administered by Nationwide Mutual Insurance Company, a Fortune 100 company offering various types of insurance and financial products.

Before you buy a plan, check to see if you already have coverage through a premium travel credit card, and if so, verify whether those limits are sufficient. If they are, standalone emergency medical coverage may be adequate as the travel insurance provided by credit card often excludes healthcare expenses or offers a low limit (the Chase Sapphire Reserve® is one of the few cards to offer emergency medical and dental, however coverage is capped at $2,500).

Here’s what you need to know about World Nomads travel insurance to help you decide which plan makes sense for your trip.

Standard and Explorer plans by World Nomads

World Nomads offers two plans: Standard and Explorer, with the latter offering higher limits and additional adventure sports coverage. The plans can be purchased for trip duration up to a maximum 180 days, and you can extend your coverage mid-trip. The price of the policy will depend on the duration of the trip and the countries that you're visiting.

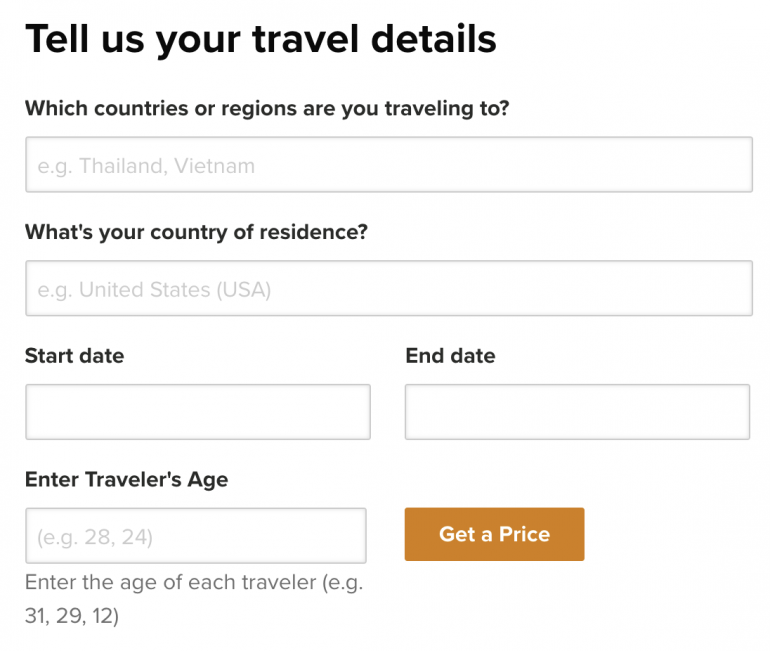

To see the cost of the insurance plan, you will need to input your trip details, your age and state of residence. Unlike many other insurers, you do not need to include the cost of your trip when searching for a World Nomads policy because trip cancellation and interruption benefits are capped at a specific dollar amount rather than a percentage of coverage.

We input a sample trip of a two-week vacation to Italy by a 30-year-old from Illinois.

World Nomads | Standard Plan Coverage Limits | Explorer Plan Coverage Limits |

Trip Cancellation | $2,500 | $10,000 |

Trip Interruption | $2,500 | $10,000 |

Trip Delay | $500 | $1,500 |

Daily Limit | $250 | $250 |

Emergency Accident & Sickness Medical Expense | $100,000 | $100,000 |

Emergency Dental | $750 | $750 |

Hospital Advancement | $500 | $500 |

Pre-existing Medical Conditions | Not covered | Not covered |

Emergency Evacuation | $300,000 | $500,000 |

Repatriation of Remains | $300,000 | $500,000 |

Non-Medical Emergency Transportation | $25,000 | $25,000 |

Baggage & Personal Effects | $1,000 | $3,000 |

Per Article Limit | $500 | $1,500 |

Combined Maximum Benefit (for jewelry, watches, silver, gold, or platinum items, or furs) | $500 | $500 |

Baggage Delay (outward journey only) | $750 | $750 |

Daily Limit | $150 | $150 |

Rental Car Damage (not available in NY, OR or TX) | Not included | $35,000 |

Accidental Death & Dismemberment | $5,000 | $10,000 |

Generali Global Assistance 24-Hour Services | Unlimited | Unlimited |

Adventure Sports & Activities | Standard Plan Sports & Activities as listed for U.S. residents | Standard & Explorer Plan Sports & Activities as listed for U.S. residents |

Policy Cost | $79 | $142 |

The Standard Plan ($79) is a good choice for those who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain adventure sports. However, this plan still shines in sports coverage, covering activities like wind surfing and bungee jumping, which are seldom covered by travel insurance companies. A full list of covered sports by plan type is available on the World Nomads site.

The Explorer Plan ($142) includes all the benefits of the Standard Plan along with higher limits, rental car damage insurance (in the states where it is available) and adventure sports (e.g., skydiving, heli skiing) coverage. This choice is also good for those whose trips costs less than $10,000 as this is the maximum trip cancellation and interruption protection.

A Cancel For Any Reason (CFAR) upgrade is not offered by World Nomads. If this option is a must, look for a travel insurance company that offers CFAR.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

Which World Nomads insurance plan is best for me?

Selecting the appropriate plan for your travels involves understanding which coverage you’d like on the trip.

If you have a premium travel card that offers an adequate amount of trip cancellation / interruption benefits, you may only need to get a standalone emergency health care policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Explorer Plan ($10,000) has a comparable level of trip cancellation protection.

If you don’t have a premium travel credit card, the coverage provided by your card isn’t sufficient or you didn’t use the card to pay for your trip, then a comprehensive insurance plan like the Standard or Explorer plan might be the best choice.

If you don’t need adventure sports coverage and your trip costs less than $2,500 (or you already have trip cancellation / interruption benefits from your credit card), the Standard Plan would be sufficient.

» Learn More: How to find the best travel insurance

How to choose an World Nomads plan online

Go to worldnomads.com and input your trip details.

If your country of residence is the U.S., an additional row will appear asking you to input your state.

What isn’t covered

Trip insurance plans are filled with exclusions, so you’ll want to pay attention to what is and isn’t covered so there aren’t any surprises. Here are some exclusions you can expect from World Nomads:

Pre-existing conditions: If you’ve sought treatment for any illness or condition in the 90-day period preceding the start of the policy and then seek medical care for the same illness/condition, you may be on the hook for the bill since World Nomads does not cover pre-existing conditions.

Intentional acts: Losses sustained from self-harm, intoxication, drug use or criminal activity are not covered.

» Learn more: The majority of Americans plan to travel in 2022

Pros and cons of World Nomads insurance

Pros:

Insurance can be extended mid-trip.

You can insure trips up to 180 days in length.

Adventure sports coverage is more robust than many other plans.

Simple choice of two plans.

Cons:

Extreme sports are not covered.

There is no annual plan option. A policy ends once you return within 100 miles of home, even if you’re only home briefly as part of a long trip.

Regardless of your trip cost, trip cancellation and interruption coverage is capped at a dollar amount rather than as a percentage of trip cost. The Standard Plan and Explorer Plan cover trips up to $2,500 and $10,000, respectively. If you’re going on a more expensive trip, you won’t be able to protect the entire trip.

You must be 70 years old or younger to qualify for coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

A previous version of this article misstated World Nomads' insurance offerings. This article has been corrected.